If your email or mobile number has changed and you’re not receiving OTPs or alerts from the E-Way Bill portal, don’t worry. Updating these details is a simple two-step process. You just need to update your mobile number or email on the GST portal, and then reflect it on the E-Way Bill portal.

Let’s understand this with easy steps and clear screenshots. 👇

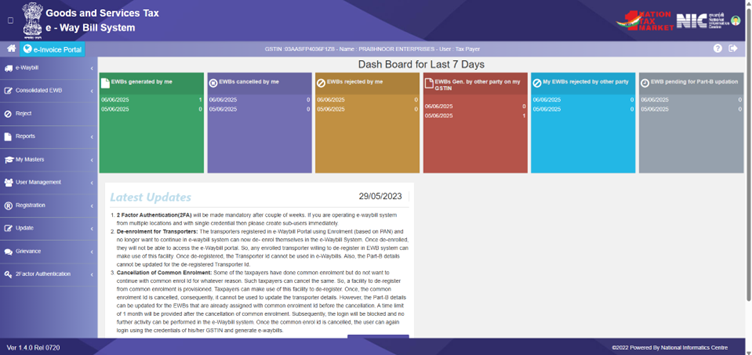

Step 1: First, Visit the E-Way Bill Portal

Go to ewaybillgst.gov.in and log in using your credentials.

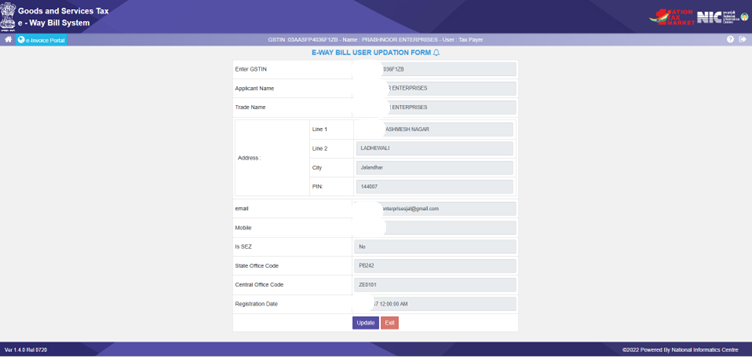

Once you log in, you’ll see this screen:

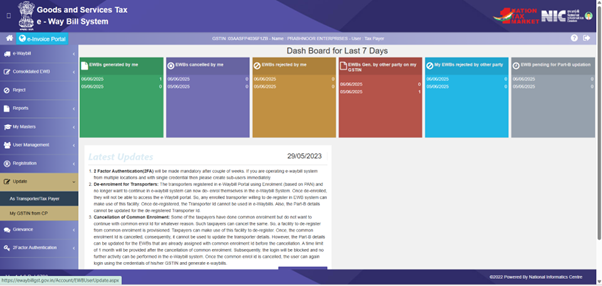

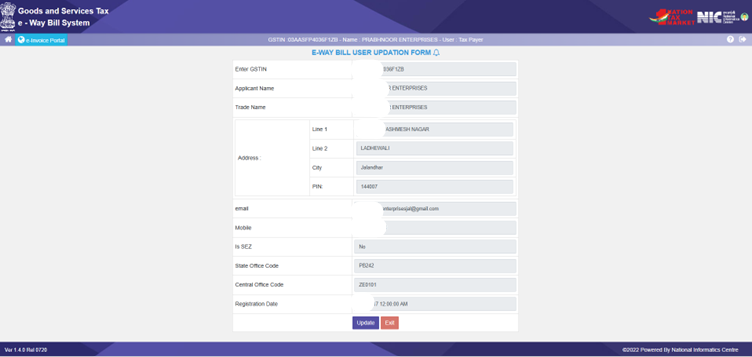

Step 2: Click on “Update” → “My GSTIN from CP”

Now on the left side menu, click the “Update” button. From the dropdown, select:

“My GSTIN from CP”

(CP stands for Common Portal i.e. the GST portal)

This will open a page that shows your GST-registered details such as:

- Name

- Address

- Mobile number

- Email ID

There will also be an Update button. But before clicking it, make sure your mobile/email is updated on the GST portal. Let’s see how to do that.

Step 3: Update Email or Mobile Number on GST Portal

Follow these steps:

- Go to www.gst.gov.in and log in.

- Navigate to:

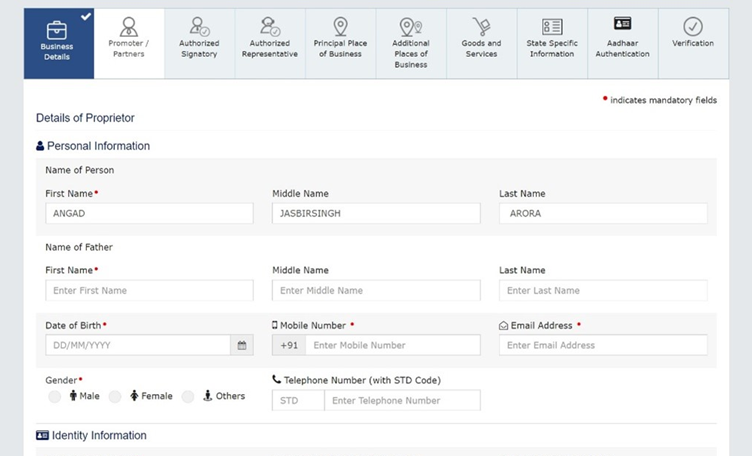

Services → Registration → Amendment of Registration Non-Core Fields

- A form will open. Now click on the second tab:

“Promoter / Partners”

Here, you’ll find the Email ID and Mobile Number fields.

Update the new contact details → Save the form → Submit with DSC or EVC.

Step 4: Wait for Auto-Approval

Usually, your updated email or mobile number gets approved within 2–3 hours (if all validations are correct).

Once approved, go back to the E-Way Bill portal and hit the Update button under “My GSTIN from CP”.

Now your updated contact details will reflect on the E-Way Bill system as well.

Legal Reference:

- This amendment is done under Rule 19 of CGST Rules, 2017 which allows updating of non-core fields.

- The E-Way Bill system pulls data from the GST portal through the Common Portal (CP) integration.

Final Words:

It’s important to keep your email and mobile number updated on both portals to avoid any OTP delivery issues during E-Way Bill generation.

This simple process ensures seamless compliance with the GST laws.

Feel free to follow this guide or share it with someone who needs help.