Starting a new business in India involves careful planning and adherence to essential legal and tax requirements. Whether you’re setting up a small shop or a private limited company, knowing these steps will help you start on the right foot.

Step-by-Step Checklist for Starting a Business

Here’s a simplified checklist to ensure your business meets all necessary legal and tax compliance requirements before operations begin:

| Step | Compliance Activity |

|---|---|

| 1 | Decide business structure (Sole Proprietorship, Partnership, LLP, Pvt Ltd.) |

| 2 | Obtain PAN and TAN from Income Tax Department |

| 3 | Register for GST if turnover threshold crosses ₹20 lakh |

| 4 | Register under Shops & Establishments Act |

| 5 | Apply for Professional Tax registration (State-specific) |

| 6 | Register for EPF (Employee Provident Fund) and ESI (Employee State Insurance) if applicable |

| 7 | Obtain MSME (Udyam) registration for benefits |

| 8 | Secure industry-specific licenses (FSSAI, Trade License, Pollution Clearance, etc.) |

| 9 | Maintain proper books of accounts and plan for annual audit |

| 10 | Register Intellectual Property (Trademarks, Patents) |

Important Tax Registrations Explained

1. PAN & TAN:

PAN (Permanent Account Number): Mandatory for all businesses to file income tax. TAN (Tax Deduction and Collection Account Number): Required for businesses deducting TDS (Tax Deducted at Source).

2. GST (Goods & Services Tax):

Mandatory for businesses crossing turnover thresholds or involved in interstate supply.

GST Threshold Limits:

| Category | Threshold Limit (₹) |

| Regular States | ₹20 lakh |

| Special Category States (NE, J&K) | ₹10 lakh |

| Interstate Supply & e-commerce | Mandatory (No limit) |

Labour Law Compliances

Businesses must comply with labor laws ensuring employee benefits and safety:

| Compliance | Applicability | Threshold |

| Employees’ Provident Fund | Employees ≥ 20 | 20 Employees |

| Employees’ State Insurance | Employees ≥ 10, salary ≤ ₹21,000 | 10 Employees |

| Shops & Establishments Act | All commercial establishments | All Businesses |

Sector-Specific Registrations

| Business Type | License/Registration |

| Restaurants | FSSAI Food License |

| Factories | Pollution Control Clearance |

| Exporters | IEC Code (DGFT) |

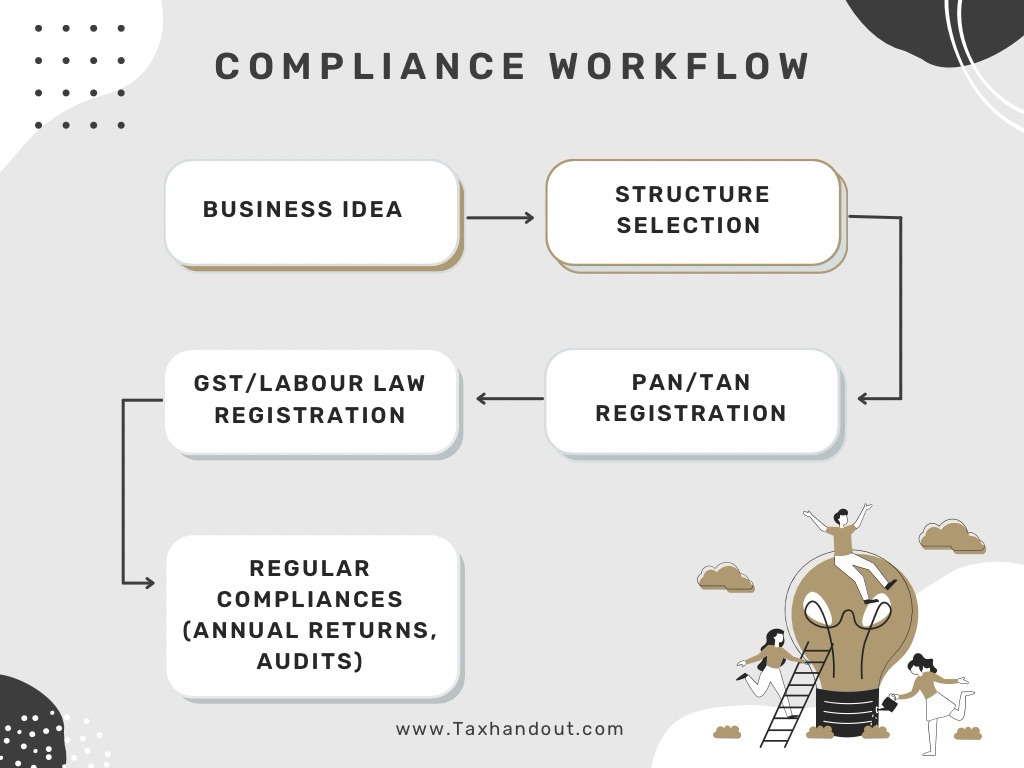

Visual Representation of Compliance Workflow

Regular Compliance and Filings

Maintaining compliance is continuous:

- Filing of Income Tax returns annually.

- GST returns monthly/quarterly.

- Annual ROC filings for companies.

- Periodic audits depending on business structure and turnover.

Why Compliance Matters?

Proper compliance:

- Protects your business from legal penalties.

- Enhances credibility and reputation.

- Ensures smooth operations without regulatory interruptions.

Conclusion

Following the legal and tax compliance roadmap carefully will safeguard your business from unnecessary challenges. Start right, stay compliant, and enjoy sustainable growth.