The GSTN has issued two major updates in June 2025, both directly impacting how we handle Input Tax Credit (ITC) and file GSTR-3B:

- How to fix wrongly rejected invoices or credit notes on the IMS (Invoice Matching System)

- From July 2025, the auto-populated liability in GSTR-3B will become non-editable

Let’s explore both updates in detail, with step-by-step instructions & portal screenshots.

Part 1: Navigating the Invoice Matching System (IMS) on GST Portal

What is IMS?

The Invoice Management System (IMS), introduced on 14th October 2024, aims to make it easier for taxpayers to match their invoices with those uploaded by suppliers, which is crucial for claiming Input Tax Credit (ITC). This system offers flexibility in reviewing and taking action on invoices, helping taxpayers to ensure accuracy before filing GSTR-3B.

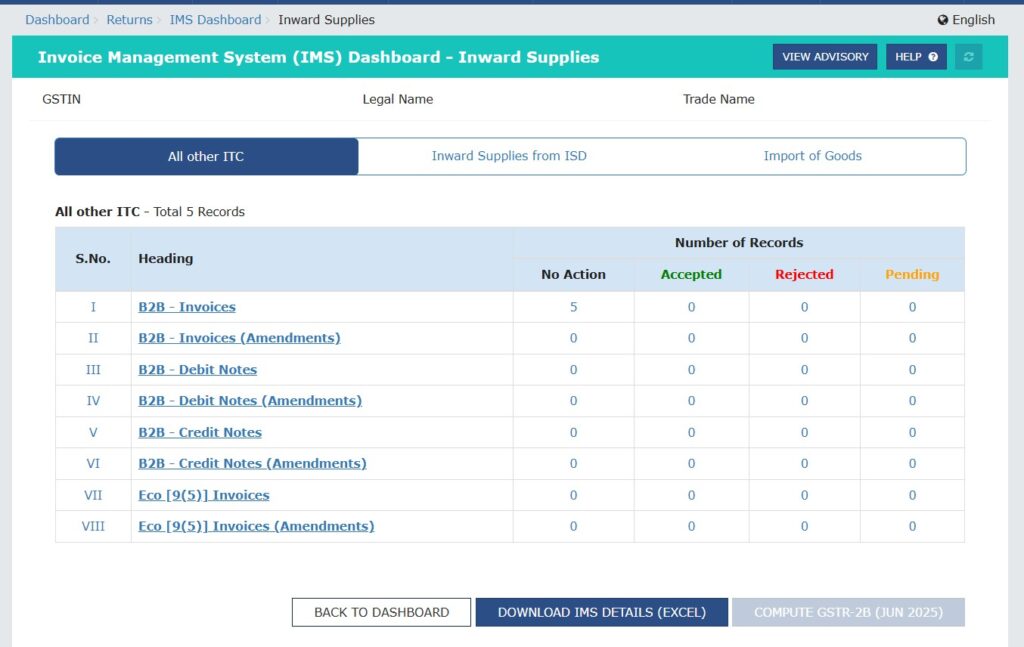

IMS (Invoice Matching System) is the new interface on the GST portal where:

- Recipients can view invoices, debit notes, and credit notes uploaded by suppliers

- They can either:

- ✅ Accept

- ❌ Reject

- 🕒 Keep Pending (for clarification)

This directly impacts the auto-generation of GSTR-2B and subsequently, ITC claim in GSTR-3B.

How to Access IMS on GST Portal?

Step-by-Step Navigation:

- Login to www.gst.gov.in

- Click on “Invoice Matching System (IMS)” tab under ‘Returns’ tab.

- You will now see your IMS Dashboard, which includes:

- Inbound Supplies (Invoices/CNs/DNs uploaded by suppliers)

- Actions (Accept, Reject, Pending)

- Status Tracker (Accepted, Rejected, Modified)

- Recompute GSTR-2B button

IMS Dashboard Features

| Tab | Description | Action |

| Pending for Action | All new records awaiting your action | Accept / Reject / Keep Pending |

| Accepted | List of accepted records that will be included in GSTR-2B | No change needed |

| Rejected | Invoices/CNs you rejected – can be re-uploaded by supplier | Inform supplier for correction |

| Modified | Records changed by supplier or you via GSTR-1A | Review and accept if correct |

| Recompute GSTR-2B | Updates your 2B based on new accepted records | Click after any change |

Part 2: Wrongly Rejected Invoices in IMS? Here’s How to Fix It

Advisory Issued: 19th June 2025

Topic: Fixing Rejected Invoices / Credit Notes in IMS (Invoice Matching System)

What’s the Problem?

Under IMS, when a supplier uploads invoices, debit notes, or credit notes, the recipient (buyer) can:

- ✅ Accept

- ❌ Reject

Sometimes, recipients wrongly reject valid documents, and later realize they:

- Missed ITC on an invoice, or

- Didn’t reverse ITC for a credit note

What’s the Solution?

Case 1: Mistakenly Rejected Invoice / Debit Note

Steps to Correct:

- Ask your supplier to report the same document again (no change):

- In GSTR-1A of the same month, or

- In Amendment Table of next month’s GSTR-1/IFF

- Once it shows again in your IMS:

- Accept it

- Recompute GSTR-2B

- Claim full ITC

Note: ITC will be available only in the month the corrected invoice appears in GSTR-2B.

Case 2: Mistakenly Rejected Credit Note

Steps to Correct:

- Ask supplier to re-upload the same Credit Note via:

- GSTR-1A (same month) OR

- Amendment Table (any upcoming GSTR-1/IFF)

- Accept the CN in IMS

- Recompute GSTR-2B

Result: System will auto-reduce your ITC based on the value of the CN.

What About the Supplier?

Whether it’s an invoice or credit note, if the same values are re-uploaded:

- Supplier’s tax liability will NOT increase

- Because the amendment table works on delta (difference) value — and if there is no change, difference is zero

Quick Summary Table:

| Mistake | What to Do | ITC/Liability Impact |

| Rejected invoice | Supplier re-reports in GSTR-1A or Amendment Table | Buyer can claim full ITC again |

| Rejected CN | Supplier re-reports in GSTR-1A or Amendment Table | Buyer’s ITC gets reduced |

| Supplier’s impact | No extra liability if value is same | No double tax |

Part 3: Auto-Populated Liability in GSTR-3B Will Become Non-Editable

Advisory Issued: 7th June 2025

Effective from: July 2025 Tax Period (filing due August 2025 onwards)

What’s the Current Rule?

Currently:

- When you file GSTR-1/IFF, the system auto-fills GSTR-3B based on outward supplies.

- But you can edit this liability in GSTR-3B manually before filing.

What’s Changing?

From July 2025, GSTR-3B liability will become non-editable.

Instead, you must make corrections using:

GSTR-1A – a new return that allows you to:

- Amend outward supply details (if GSTR-1 was wrong)

- Fix any overstatement/understatement of liability before GSTR-3B is filed

What’s the Correct Process from July 2025 Onward?

- Upload GSTR-1/IFF

- If any mistake → file corrections in GSTR-1A for same tax period

- GSTR-3B gets auto-populated → now cannot be edited

- File GSTR-3B based on system-calculated values

Corrections to GSTR-1 must be done via GSTR-1A before filing GSTR-3B

Why This Change?

- To ensure accurate and consistent liability

- To promote data matching between GSTR-1 and GSTR-3B

- To reduce chances of tax evasion or reporting mismatch

Reference Advisories:

- 📄 January 27, 2025: Pre-filled GSTR-3B framework

- 📄 October 17, 2024: Functional flow of GSTR-1A and auto-population rules

Final Note:

These changes are a big step toward automation and accuracy in GST compliance.

If you’re a buyer: Always double-check before rejecting anything in IMS

If you’re a supplier: Coordinate with recipients and use GSTR-1A if needed

For everyone: From July 2025, treat GSTR-1 + GSTR-1A as your final liability base before filing GSTR-3B

Action Checklist for July 2025 Onward:

✅ Review IMS weekly for rejected records

✅ Train staff to double-check before rejecting documents

✅ Use GSTR-1A if any correction is needed

✅ Don’t wait till last day to file GSTR-3B

✅ Recompute GSTR-2B after accepting corrections