What is Section 44AD?

Section 44AD of the Income Tax Act, 1961 provides small businesses in India with a simplified way to calculate their taxable income.

Instead of maintaining detailed books of accounts and undergoing audits, eligible taxpayers can declare income at a fixed percentage of turnover and file their Income Tax Return (ITR) quickly.

This is part of the Presumptive Taxation Scheme (PTS) introduced to reduce the compliance burden for small businesses.

Who Can Opt for Section 44AD?

The following taxpayers are eligible:

- Resident Individuals (Sole Proprietorship businesses)

- Hindu Undivided Families (HUFs)

- Partnership Firms (other than LLPs)

Ineligible Categories:

| Not Eligible | Reason |

| ❌ Non-residents | Must be resident in India |

| ❌ LLPs | Explicitly excluded |

| ❌ Companies | Not allowed |

| ❌ Professionals (Doctors, CAs, etc.) | Covered under Section 44ADA |

| ❌ Agency businesses, commission, and brokerage income earners | Excluded under Section 44AD(6) |

Turnover/Gross Receipt Limit

| Mode of Transaction | Turnover Limit |

| Digital Mode (≥95% receipts non-cash) | ₹3 Crore |

| Non-digital (more than 5% cash transactions) | ₹2 Crore |

Digital receipts include: Payments received via banking channels, UPI, debit/credit cards, NEFT, RTGS, IMPS, etc.

How to Calculate Presumptive Income Under Section 44AD?

| Type of Receipt | Minimum Presumptive Income Rate |

| Cash Receipts | 8% of turnover |

| Digital Receipts | 6% of turnover |

✅ Taxpayer can declare higher income than prescribed rates.

Important:

If you want to declare lower income than the above rates, and your income exceeds the basic exemption limit, you must get your books audited under Section 44AB.

Example Scenario:

Business: Mr. Sahil Mehta runs a general store in Punjab.

FY 2024-25 Turnover: ₹1.90 Crore

Digital Receipts: 97% of total sales

| Details | Amount |

| Turnover | ₹1.90 Crore |

| Applicable Rate | 6% (as receipts are digital) |

| Presumptive Income | ₹11.40 lakh |

Tax Calculation:

- Income will be taxed at slab rates applicable after considering Chapter VIA deductions (like 80C, 80D, etc.).

How to Fill Section 44AD Details in ITR-4

When filing ITR-4 for presumptive taxation under Section 44AD, you need to fill the following key sections carefully:

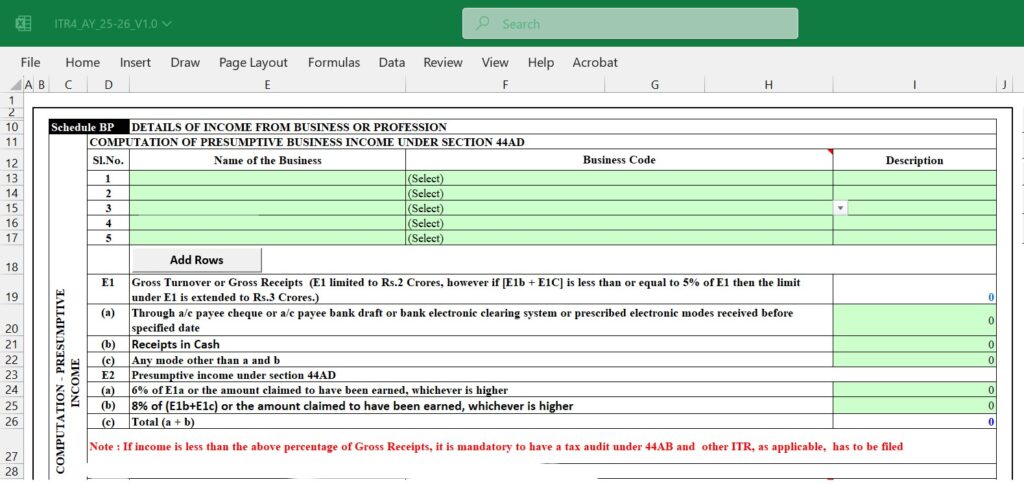

1. Schedule BP – Details of Income from Business or Profession (Presumptive Income)

| Field | Details to Fill |

|---|---|

| Name of Business | Select the nature/type of your business from the dropdown |

| Business Code | Select correct business code from the predefined list |

| Gross Turnover (E1) | Mention total gross receipts or sales for FY 2024-25 |

| E1(a) | Digital receipts (through bank, UPI, etc.) |

| E1(b) | Cash receipts |

| E1(c) | Other receipts (if applicable) |

| E2 | Calculate presumptive income: |

| ✔️ 6% of digital receipts (E1a) | |

| ✔️ 8% of cash receipts (E1b + E1c) | |

| Then total them under E2(c) |

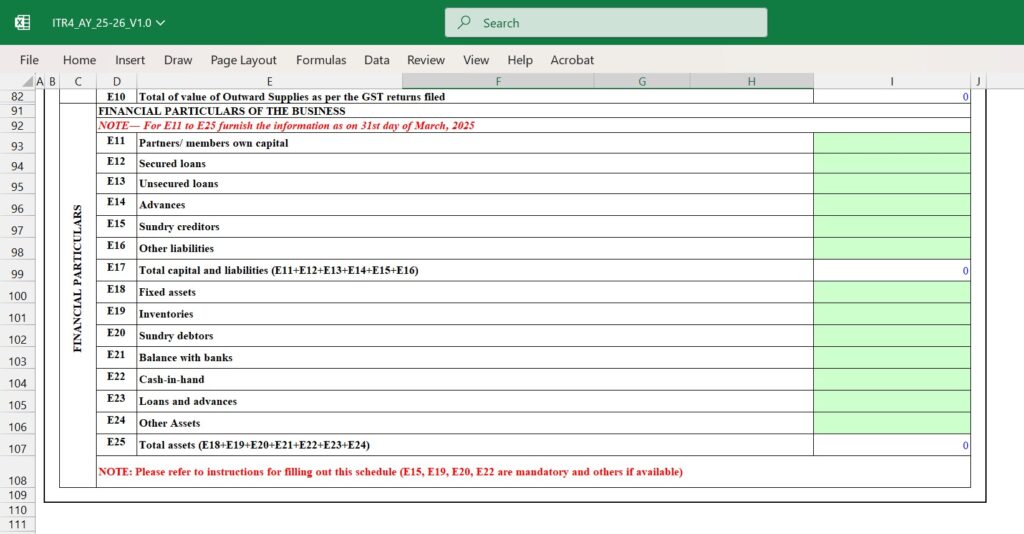

2. Schedule Financial Particulars (Mandatory for Presumptive Filers)

You must provide basic financial information as of 31st March 2025, including:

| Compulsory Field | Description |

|---|---|

| E15 | Sundry creditors |

| E19 | Inventories |

| E20 | Debtors |

| E22 | Bank Balance |

Benefits of Section 44AD

| Benefit | Explanation |

| ✅ No Books of Accounts | Exempted from Section 44AA |

| ✅ No Audit Required | Unless declaring lower income |

| ✅ Simple Tax Filing | File using ITR-4 |

| ✅ Reduced Compliance | Less paperwork and documentation |

Mandatory Provisions – Points to Remember

| Provision | Applicability |

| 📅 Advance Tax | 100% of estimated tax must be paid by 15th March of the Financial Year. Failure to pay will attract interest under Sections 234B and 234C. |

| 🔁 5-Year Lock-In Rule | Once opted out, you cannot opt back for next 5 years without audit |

| 📝 ITR Form | File return using ITR-4 Sugam |

| ❌ No Further Deductions | No business expense deduction allowed (Section 30 to 38 disallowed separately) |

| 📋 Reporting | Must separately disclose turnover, presumptive income, and other incomes |

Restrictions & Limitations

| Not Allowed Under Section 44AD | Notes |

| Businesses earning commission/brokerage income | Covered under Section 44AD(6) |

| Businesses running agency operations | Covered under Section 44AD(6) |

| Professionals (Doctors, Engineers, CAs, etc.) | Should use Section 44ADA |

Conclusion

Section 44AD provides a simple, hassle-free tax compliance route for small businesses in India. It reduces compliance costs, avoids audits, and promotes digital transactions.

However, taxpayers must stay aware of turnover limits, advance tax rules, and the 5-year restriction before making the choice.

Sir if We Show Cash And Bank Receipt Above 40 lakhs in case of good & 20 lakhs in case of services.Will Gst Department issue notice for Gst Tax evasion? Because We don’t registered in Gst in other case registered in Gst

Reply on both Scenarios.

Legally: Yes, the GST Department can and likely will issue a notice for GST tax evasion. If your turnover exceeds the prescribed threshold, GST registration is legally compulsory. Failing to register when required is a serious offense under GST law.

Here is the Detection Mechanisms:

o Data Matching (PAN-based): While the GST department may have some initial difficulty detecting unregistered entities, the linking of GSTINs to PANs, and the increasing use of data analytics and artificial intelligence by tax authorities, makes it possible. Your Income Tax returns (which are PAN-based) show your total receipts. If these receipts are significantly above the GST threshold, it creates a red flag that the GST department can cross-reference.

o Bank Transactions: Banks report high-value transactions to tax authorities. Large cash deposits or significant bank transfers consistent with a business exceeding the threshold can trigger scrutiny.

o E-way Bills: If you are involved in the movement of goods, e-way bills are generated. These can reveal your business activities and turnover, even if you are unregistered.

o Third-Party Information: If you transact with GST-registered businesses, their GST returns will show transactions with you (even if you’re unregistered). A mismatch in data or a registered buyer claiming ITC on supplies from an unregistered person can alert the authorities.

o Complaints/Tip-offs: Competitors or even disgruntled customers can tip off the department.

o Surveys and Audits: The department conducts random audits and surveys, especially in sectors known for cash transactions.