Filing Income Tax Returns (ITR) is not just a statutory obligation—it’s an essential step in maintaining financial discipline and avoiding penalties. For Assessment Year 2025–26, the last date for filing ITR (without audit) was September 15, 2025.

But as the deadline approached, millions of taxpayers and professionals faced non-functional portals, slow uploads, error messages, and downtime.

Hashtags like

#Extend_Due_Date_Immediately,

#extend_due_dates_immediately, and

#extend_ITR_TAR_duedates

started trending on X (Twitter), reflecting the widespread frustration across the country.

The Ground Reality: Portal Glitches on Peak Days

The Income Tax e-filing portal, meant to simplify compliance, often collapses under the surge of last-minute filings. This year has been no exception:

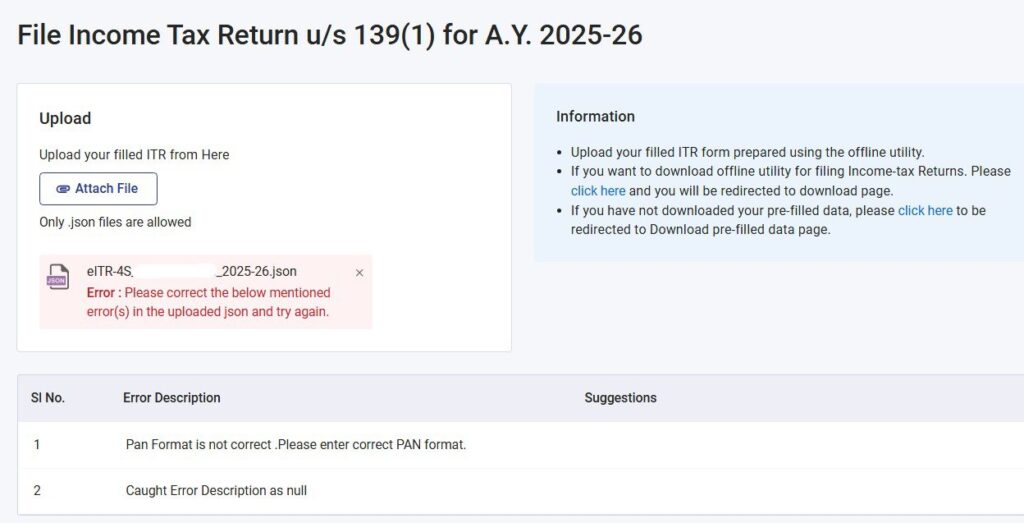

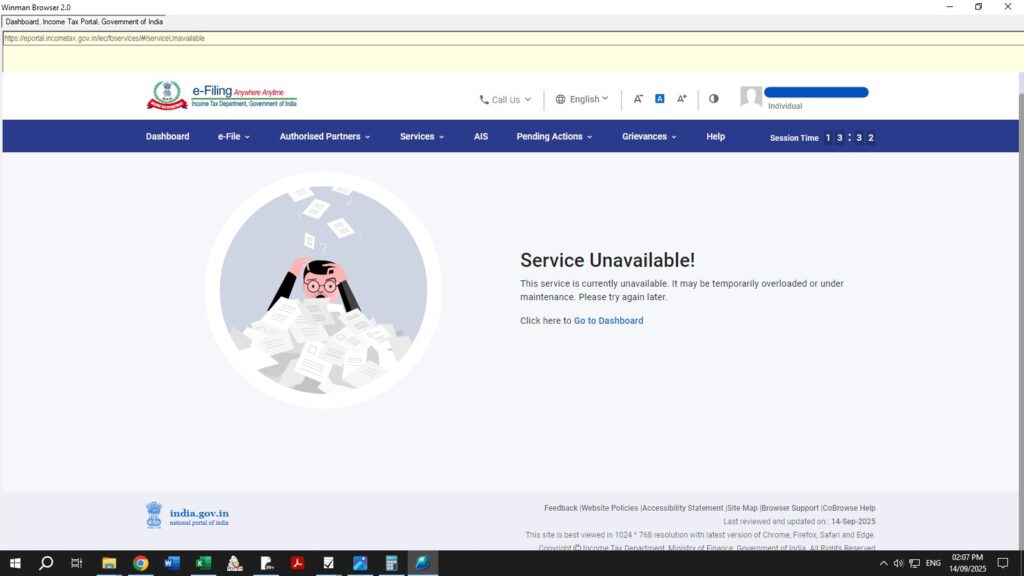

- Downtime issues: Users reported that the portal went offline or showed frequent “try again later” errors.

- Slow uploads: Many returns could not be uploaded despite multiple attempts.

- Low filing numbers: As of September 13, only 6 crore ITRs were filed, with nearly 2 crore taxpayers still pending.

- Advance Tax Payment Glitches: September 15, 2025, is not only the ITR deadline but also the last date for paying Advance Tax (2nd Installment). Shockingly, even the tax payment option (Challan & Net Banking integration) on the portal showed failures and errors, leaving taxpayers unable to discharge their liability on time.

Despite repeated claims from the Income Tax Department that the portal is “operational,” ground reports suggest otherwise.

Why Timely Extensions Are Essential

While deadlines are necessary to ensure discipline, timely extensions during genuine technical glitches are equally important:

- Avoiding Unnecessary Penalties

Taxpayers who try but fail to file due to technical reasons shouldn’t be penalized with late fees and interest. - Reducing Professional Pressure

Chartered Accountants and tax professionals manage hundreds of clients. A non-functional portal during peak filing season not only causes stress but also leads to unavoidable errors. - Ensuring Accurate Compliance

When taxpayers rush due to technical delays, the chances of incorrect filings increase, leading to notices and rectifications later. - Advance Tax Impact

Missing the Advance Tax deadline because of a faulty portal can lead to interest u/s 234B & 234C. Taxpayers must not be forced to pay additional interest due to reasons beyond their control. - Maintaining Trust in Digital India

If the government promotes digital compliance, it must also ensure that the infrastructure is reliable.

Voices from the Community

Professional bodies like the All India Tax Bar Association and even MPs from ruling and opposition parties have requested an extension till October 15, 2025, citing portal issues and natural calamities in some regions.

In fact, most tax associations across India have already written letters to the Ministry of Finance, highlighting these difficulties and urging for an immediate extension. Unfortunately, there has been no official response from the Ministry as of now, further frustrating taxpayers and professionals.

The tax community’s message is clear: Ease of Doing Business should reflect in tax compliance too.

The Income Tax Department must acknowledge that portal glitches on the last dates are a recurring reality. Instead of denying the issue, a proactive extension of due dates should be announced in advance whenever such large-scale disruptions occur.

This will not only relieve taxpayers and professionals but also strengthen confidence in India’s digital tax ecosystem.

As taxpayers demand online with hashtags like #Extend_due_date_now, it is high time the government ensures that technical hurdles don’t become financial penalties.

Due date should be extended in time to reduce the stress the professional are facing right now