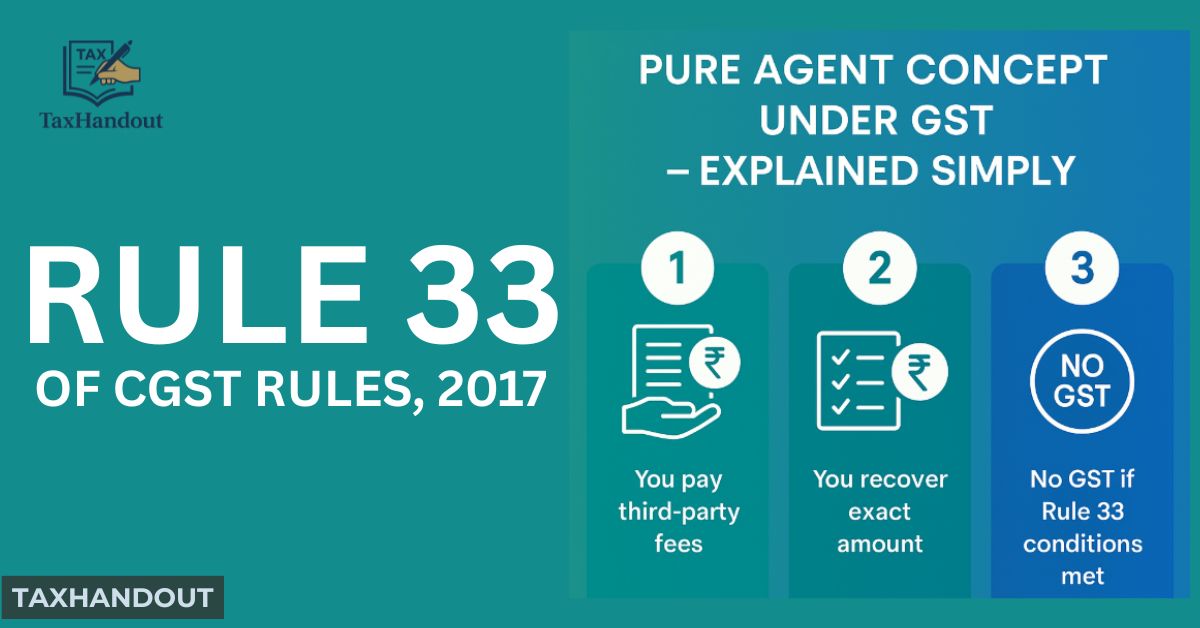

Reimbursements create confusion for many taxpayers. Most business owners assume that if they pay something “on behalf of a client,” GST will not apply.

This is a myth.

Rule 33 of the CGST Rules does not provide a blanket exemption for reimbursements. The rule is narrow, strict, and often misunderstood—leading to heavy tax demands during departmental audits.

In this article, I break down the Pure Agent concept in clear and practical terms, with real examples that every business and professional can relate to.

What Is a Pure Agent Under GST?

A Pure Agent is someone who:

- Pays a third party on behalf of the client,

- Recovers only the actual amount later,

- Does not personally use the service or goods,

- Does not add any profit, fee, or handling charge.

If all conditions of Rule 33 are satisfied, the reimbursed amount is excluded from the taxable value.

In simple words:

GST should apply only on your own service, not on pass-through payments that do not benefit you.

Why Pure Agent Concept Exists

Services like CA, legal consultancy, architecture, and compliance work often require payment of government fees, statutory dues, or external charges.

These payments relate to the client—not to the service provider.

Rule 33 ensures that GST is not wrongly charged on such statutory fees.

But this relief is available only when the professional truly acts as an intermediary.

Golden Rule:

If the expense benefits you in any way while providing the service, it fails the Pure Agent test.

All Conditions Must Be Met (The Audit Checklist)

You qualify as a Pure Agent only when all conditions below are satisfied. Missing even one condition means the amount becomes taxable.

1. Conditions Related to Invoice & Liability

- The third-party invoice should ideally be in the client’s name.

- The client must explicitly authorise you to make the payment.

- The liability to pay the third party should be that of the client, not yours.

2. Conditions Related to Usage

- You do not hold title to the goods/services purchased.

- You do not use those goods/services personally or for your business.

3. Conditions Related to Recovery

- You recover only the actual amount paid — no markup, no convenience fee, no handling charges.

- The reimbursed amount must be shown separately in your invoice.

Expenses That Qualify as Pure Agent

These items generally qualify because the liability belongs to the client:

- ROC filing fees

- GST or Income Tax registration fees

- Stamp duty on agreements

- Court fees

- Customs duty paid by a CHA

- Merchant Overtime Fee (MOF) paid to Customs

These charges offer no benefit to the professional and relate directly to the client.

Expenses That Do NOT Qualify (Common Mistakes)

The following expenses are commonly misclassified as “reimbursements,” but they do not qualify as Pure Agent expenses under Rule 33 or Section 15(2)(c):

- Travel expenses (taxi, train, flight)

- Hotel and food bills

- Out-of-pocket expenses during a client visit

- Printing, courier, stationery

- Telephone and internet charges

Why are these taxable?

Because these expenses help you perform your service.

They are part of your cost—not the client’s statutory liability.

Therefore, GST must be charged on them even if you recover them “at actuals.”

Correct Example: Pure Agent

Scenario: A CA files AOC-4 for a client.

- Professional Fee: ₹5,000

- ROC Fee: ₹500 (Challan in client’s name, paid by CA)

Correct Invoice Format

| Particulars | Amount (₹) |

|---|---|

| Professional Charges | 5,000 |

| GST @ 18% | 900 |

| ROC Fee (Pure Agent) | 500 |

| Total Payable | 6,400 |

Outcome: GST is charged only on the professional fee.

The ROC fee remains outside GST valuation.

Incorrect Example: The “Actuals” Trap

A consultant travels to visit a client:

- Consultancy Fee: ₹10,000

- Flight & Hotel: ₹5,000

The consultant invoices only ₹10,000 + reimbursed ₹5,000 and does not charge GST on reimbursements.

This is incorrect.

Flight/hotel expenses are incidental costs incurred by the consultant to provide service, not by the client. Thus, GST is payable on the full amount.

Correct Invoice

| Particulars | Amount (₹) |

|---|---|

| Consultancy Charges | 10,000 |

| Out-of-Pocket Expenses (Flight/Hotel) | 5,000 |

| Subtotal (Taxable Value) | 15,000 |

| GST @ 18% | 2,700 |

| Total Payable | 17,700 |

The consultant may claim ITC on flight/hotel GST.

Common Confusion: Should Statutory Payments Be Included in the Invoice?

This is where most professionals get stuck.

Let’s understand it through a practical situation.

Scenario

- You raise an invoice for professional fees: ₹1,00,000

- You pay ₹2,50,000 as Income Tax on behalf of the client

- You do not include ₹2,50,000 in your invoice

- Client pays you ₹3,50,000 in total (₹1,00,000 + ₹2,50,000)

What is your aggregate turnover for GST registration?

👉 Your aggregate turnover is ₹1,00,000 only.

The statutory dues do not form part of turnover because:

- They are not in the invoice

- They are not consideration for service

- They are not income

- They are merely pass-through payments

GST law cares about value of supply, not money passing through your bank account.

Had you included the statutory dues in your invoice, the situation would change drastically:

- Turnover would become ₹3,50,000

- Pure Agent conditions would need to be proven

- GST officer could attempt to tax statutory fees as incidental expenses

This is why mixing statutory payments into your invoice is risky.

What Is the Safest and Best Practice?

✔ Do NOT include statutory dues in your invoice.

Not as a line item, not as a note, not as reimbursement.

✔ Invoice only for your professional/service fees.

✔ Let the client pay statutory dues directly.

✔ If you pay on their behalf, recover it separately outside the invoice.

This keeps:

- Your GST turnover low

- Your books clean

- Your invoices safe from GST disputes

- Pure Agent conditions irrelevant

- GST registration threshold unaffected

This is the structure followed by most top CA firms, law firms, and consultants.

Practical Documentation Required for Pure Agent Claims

If you still plan to claim Pure Agent benefits, maintain:

- Written authorisation from the client.

- Third-party invoices/challans (preferably in client’s name).

- Proof of payment.

- Your invoice showing reimbursed amounts separately.

But again:

Avoid this route unless absolutely necessary.

Rule 33 is a useful provision but must be applied with discipline. Most businesses misunderstand how reimbursements work under GST, especially the difference between statutory payments and incidental expenses.

Key Takeaways

- If the expense helps you perform the service (travel, food, printing), it is taxable.

- If the expense is the client’s statutory liability and you merely facilitate it, it may qualify as a Pure Agent expense — but only with full documentation.

- The safest and most audit-proof structure is to invoice only your professional fees and handle statutory payments outside the invoice.

This helps avoid GST disputes, prevents unnecessary turnover inflation, and ensures better compliance.