The Goods and Services Tax Network (GSTN) has introduced a new online facility titled “Application for Unbarring Returns” on the GST Portal. This facility allows registered taxpayers to formally request unblocking of GST returns that have been system-barred due to continuous non-filing.

This is a significant compliance-related development, especially for taxpayers whose registrations remain active but whose returns have been blocked automatically by the system.

Legal Background

As per Rule 59(6) of the CGST Rules, read with Section 39 and Section 47 of the CGST Act, the GST system automatically bars the filing of subsequent returns when a registered person fails to furnish returns for three consecutive tax periods.

Once barred:

- The relevant return period becomes non-editable

- Taxpayer cannot file GSTR-1 / GSTR-3B

- Further compliance becomes impossible unless the block is removed

Earlier, taxpayers had to rely on manual follow-ups, emails, or physical visits to the department. This new module addresses that gap.

What Is “Application for Unbarring Returns”?

It is a system-based online application available on the GST Portal that enables taxpayers to:

- Submit a formal request for unblocking returns

- Provide reasons for non-filing

- Track the request through ARN

- Get approval electronically from the Jurisdictional Assessing Officer

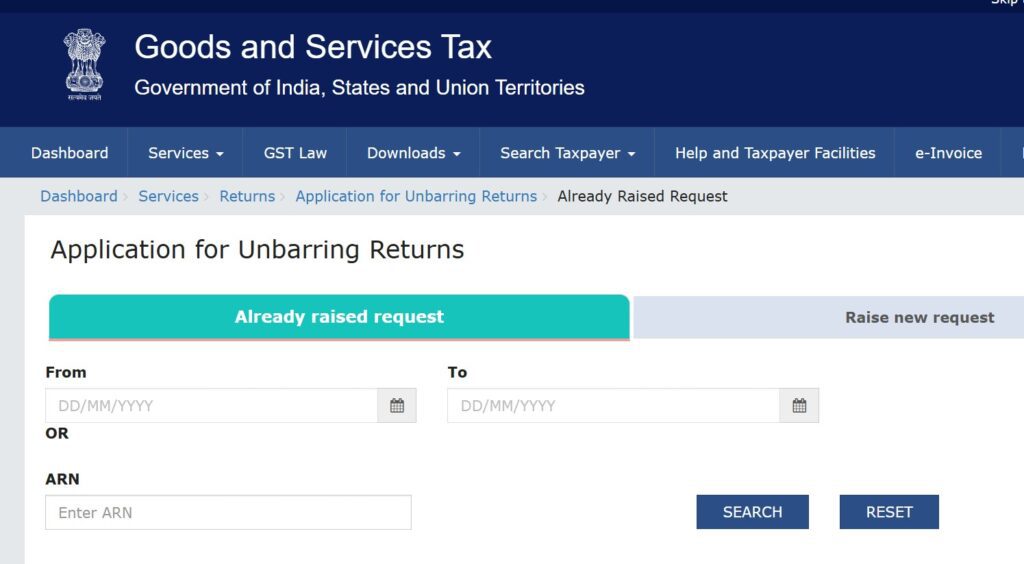

Navigation Path on GST Portal

Taxpayers can access this facility using the following path:

Dashboard → Services → Returns → Application for Unbarring Returns

The module has two tabs:

- Already Raised Request

- Raise New Request

Key Features of the New Module

1. Online Application for Unbarring

Taxpayers can now submit requests directly on the GST Portal, eliminating offline correspondence.

2. Mandatory Reason for Non-Filing

The applicant must clearly mention:

- Reason for delay or default

- Genuine hardship, financial issues, or operational constraints

Vague or casual reasons may lead to rejection.

3. Automated Routing to Jurisdictional Officer

Once submitted, the application is electronically forwarded to the concerned Jurisdictional Assessing Officer for review.

4. Approval Enables Return Filing

If the officer is satisfied:

- The request is approved

- The blocked return period becomes unbarred

- Taxpayer can immediately proceed with filing pending returns

Practical Significance for Taxpayers

This facility is important because:

- It introduces process transparency

- Reduces dependency on manual approvals

- Saves time and compliance cost

- Encourages voluntary compliance

- Supports the Government’s ease of doing business initiative

From a professional standpoint, it also creates documented accountability on both taxpayer and department.

Important Practical Points (Read Carefully)

- Filing of pending returns is still mandatory after unbarring

- Late fees and interest under Section 47 will continue to apply

- Approval is not automatic; officer discretion remains

- Frequent defaults may attract closer departmental scrutiny

This module is a facilitation tool, not a waiver mechanism.

Who Should Use This Facility?

- Taxpayers whose GST returns are blocked due to prolonged non-filing

- Businesses that were temporarily inactive but registration remained active

- Taxpayers facing portal restrictions despite willingness to comply

Professional Takeaway

The “Application for Unbarring Returns” module is a welcome and overdue reform. It brings structure, traceability, and fairness into a process that earlier depended heavily on manual discretion.

However, taxpayers must understand one hard truth:

Unbarring is a relief, not forgiveness. Compliance must follow immediately, or consequences will only multiply.