1. Introduction

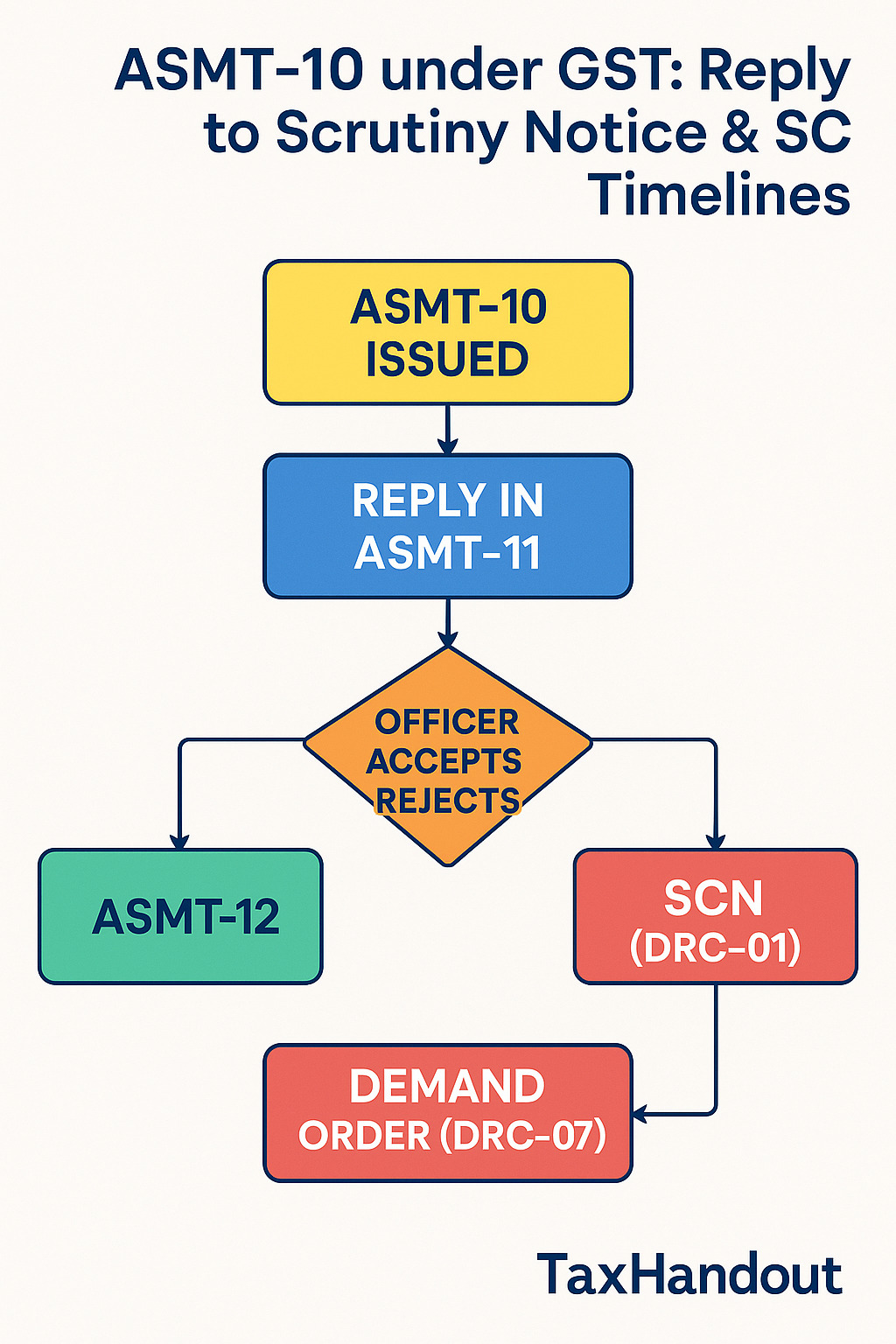

The GST law empowers officers to scrutinize returns filed by taxpayers to ensure correctness and detect mismatches. This is done through ASMT-10, issued under Section 61 of the CGST Act, 2017 read with Rule 99 of CGST Rules.

Getting an ASMT-10 notice does not always mean you are guilty of evasion—it is a chance to clarify discrepancies. However, a weak or late reply can lead to demand notices (DRC-01) and prolonged litigation.

This handout explains meaning, procedure, reply format, SCN deadlines, and practical tips for dealing with ASMT-10 effectively.

2. Legal Provisions Governing ASMT-10

- Section 61 of CGST Act: Officer may scrutinize returns and related particulars.

- Rule 99(1): If discrepancies are found → issue ASMT-10.

- Rule 99(2): Taxpayer to reply in ASMT-11 within time prescribed.

- Rule 99(3): If officer accepts reply → issue ASMT-12 (Acceptance Order).

- Section 73 / 74: If reply unsatisfactory → issue Show Cause Notice (SCN) in DRC-01.

3. What is ASMT-10?

ASMT-10 is a notice of discrepancies found in your returns or related data. It contains:

- Details of mismatch or anomaly

- Tax period involved

- Grounds of discrepancy

- Time limit for reply (generally 15 days)

👉 Important: Non-reply or weak reply can directly lead to SCN under Section 73/74.

4. Common Reasons for Issuance of ASMT-10

ASMT-10 is typically issued when department finds variances such as:

- Mismatch in outward supplies:

- GSTR-1 vs GSTR-3B

- E-way bill vs GSTR-1

- Mismatch in ITC claimed:

- GSTR-3B vs GSTR-2A/2B

- ITC claimed on blocked credits (Section 17(5))

- Inverted duty cases: Refund claimed but no proper matching.

- Turnover mismatch: GST vs Income Tax Return (ITR) vs Audit report.

- Excess refund claimed on account of zero-rated supply.

- Wrong classification / rate applied in invoices.

5. Step-by-Step Process to Reply to ASMT-10 (Form ASMT-11)

(A) On GST Portal

- Login → Services → User Services → View Additional Notices & Orders.

- Select the issued ASMT-10 notice.

- Click Reply (ASMT-11).

- Draft your reply with proper reasoning.

- Upload supporting documents (invoices, reconciliation sheets, ledgers, payment challans).

- Submit reply with DSC/EVC.

(B) Content of Reply (ASMT-11)

- Reference of Notice (ASMT-10 No. & Date).

- Factual explanation point-wise.

- Documentary proof attached.

- If tax is payable → pay via DRC-03 and attach challan copy.

- Request for closure of proceedings.

6. Format / Specimen

Notice No: ………………….

Date: ………………….

To: GSTIN XXXXXXX

Subject: Discrepancies noticed in return for Period: April–June 2024

Discrepancy:

ITC claimed in GSTR-3B = ₹15,00,000

ITC available in GSTR-2B = ₹13,50,000

Difference = ₹1,50,000

You are required to reply within 15 days in FORM ASMT-11.

Draft Reply in ASMT-11 (Sample)

Respected Sir,

With reference to ASMT-10 Notice No…….. dated…….. for April–June 2024,

we submit as follows:

- The difference in ITC is due to late filing of GSTR-1 by suppliers.

- The same invoices have now appeared in GSTR-2B of July 2024.

- Reconciliation statement attached as Annexure A.

Hence, there is no excess ITC claimed.

We request you to kindly drop the proceedings and issue ASMT-12.

Thanking You,

For XYZ Pvt Ltd

Authorized Signatory

7. Consequences of Non-Reply

- ASMT-12: If reply is accepted → no action.

- SCN (DRC-01): If reply unsatisfactory → demand proceedings under Sec 73/74.

- DRC-07: Final demand order.

8. Limitation Period for Issuing SCN (DRC-01) After ASMT-10

| Nature of Case | Section | SCN (DRC-01) Deadline | Order Deadline |

| Non-fraud cases (Section 73) | 73(10) | 3 years from due date of annual return of FY | 3 years + 3 months (Order) |

| Fraud cases (Section 74) | 74(10) | 5 years from due date of annual return of FY | 5 years + 3 months (Order) |

Example:

- FY 2021-22 → Annual Return due 31 Dec 2022.

- SCN under Sec 73 → latest by 31 Dec 2025.

- SCN under Sec 74 → latest by 31 Dec 2027.

Thus, the department cannot issue SCN beyond these timelines, even after ASMT-10.

9. Judicial References

- Madras HC in Vardhan Infrastructure Pvt Ltd (2022): Held that scrutiny under Sec 61 is preliminary; proper opportunity must be given before issuing SCN.

CBIC Instruction No. 02/2022-GST: Emphasized timely issue of ASMT-10 and monitoring closure of scrutiny cases.

10. Practical Challenges in ASMT-10

- Short reply time (15 days) – difficult for large reconciliations.

- System mismatches – GSTR-2B vs actual invoices.

- Repeated scrutiny – multiple ASMT-10 for same year.

- No clarity on adjustments when supplier rectifies later.

11. Professional Tips

- Keep monthly reconciliation of GSTR-3B, GSTR-1, GSTR-2B, books.

- Always download notices from portal – email/SMS is just an intimation.

- Pay voluntary liability via DRC-03 if discrepancy genuine.

- Preserve working papers & reply copies for audit trail.

- Track limitation dates for SCN – many notices get time-barred.

12. Conclusion

ASMT-10 is an early warning system, not a penalty notice. A proper and well-documented reply in ASMT-11 can save unnecessary litigation. At the same time, taxpayers must be aware of SCN timelines under Section 73/74, which act as a statutory safeguard against delayed demands.

👉 Key Message: Be prompt, be precise, and be prepared—ASMT-10 is an opportunity, not a threat.