On 17th September 2025, the Government issued Notification No. 13/2025 – Central Tax, bringing into effect the Central Goods and Services Tax (Third Amendment) Rules, 2025. These changes will apply from 22nd September 2025, with some provisions effective retrospectively.

The notification makes wide-ranging amendments — covering GSTR-9, GSTR-9C, refunds, appellate tribunal procedures, and ITC reporting. Taxpayers, CAs, and GST professionals need to take note of these compliance updates.

1. Changes in GSTR-9 (Annual Return)

For FY 2024-25 onwards, the annual return has been significantly modified:

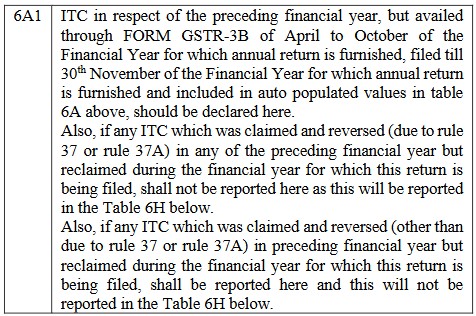

- New bifurcation in ITC reporting (Table 6A1 & Table 6A2):

- 6A1: ITC of previous financial year availed in current year.

- 6A2: Net ITC of the current financial year.

- Table 6M expanded: Now includes ITC availed through ITC-01, ITC-02, ITC-02A.

- Reversal and reclaim linkage: ITC reversed under Rule 37, 37A, 38, 42, 43 to be reported in Table 7, with corresponding reclaims in Table 6H.

- Import ITC disclosure: New fields H1 & 8H1 for IGST on imports claimed in subsequent year.

- Tables 10–13 revised: Prior-period amendments, ITC adjustments, and differential tax payments must be disclosed for FY 2024-25 onwards.

2. Changes in GSTR-9C (Reconciliation Statement)

- New disclosure for supplies on which e-commerce operators pay tax u/s 9(5).

- Reconciliation of turnover and tax liability updated with additional rows.

- Adjustments between supplier and operator reporting introduced.

- Auto-population extended for FY 2024-25.

3. Refund Procedure – Amendment to Rule 91

- with effect from the 1stday of October, 2025

- Refund order in FORM GST RFD-04 must now be issued within 7 days of acknowledgement.

- No revalidation needed if refund order is not processed timely.

- Officer may deny provisional refund if flagged by risk parameters.

This brings faster refunds but with enhanced scrutiny.

4. GST Appellate Tribunal – New Rules & Forms

- Rule 110A introduced: Appeals involving no question of law and below ₹50 lakh can be heard by a Single Member Bench.

- Safeguards provided: If law is involved, it will go to a two-member bench.

- New Forms introduced:

- APL-02A: Provisional acknowledgement of appeal.

- APL-04A: Summary of Tribunal’s order (showing final demand).

- Revised APL-05, APL-06, APL-07: For appeals, cross-objections, and applications.

This streamlines Tribunal functioning and reduces litigation delays.

5. ITC Reversals & Reclaims Reporting

- Rule-specific reporting of ITC reversals under 37, 37A, 38, 42, 43.

- Clear linkage between reversal year and reclaim year.

- Auto-population of certain ITC figures in Table 8 of GSTR-9.

New disclosures for transition credit reversals and ineligible ITC.

6. Other Technical Changes

- Rule 31A amended: “128” substituted with “140” in valuation for betting/gambling.

- Rule 39 amended retrospectively (from 1 April 2025) for distribution of credit by ISD.

- Instructions in GSTR-9 updated for FY 2024-25 compliance cut-off (30th November).

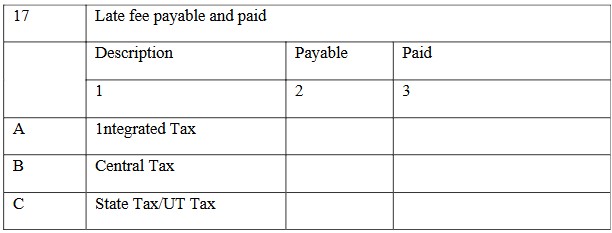

Late fee under Section 47(2) specifically included in GSTR-9C reconciliation.

Key Takeaways for Taxpayers

- Large taxpayers (turnover > ₹2 crore) should prepare for detailed ITC reporting in GSTR-9 from FY 2024-25.

- Refund applicants can expect faster processing but tighter scrutiny.

- Litigants before GSTAT will now face a streamlined system with single-member benches for smaller disputes.

- E-commerce operators & suppliers must align their GSTR-9C reporting for Section 9(5) transactions.

- Businesses must update their ERP/accounting systems to capture reversal and reclaim data rule-wise.