On 12th September 2025, the Central Board of Indirect Taxes and Customs (CBIC) issued Circular No. 251/08/2025-GST to address doubts regarding the treatment of secondary or post-sale discounts under GST.

This circular builds upon earlier clarifications (like Circular 92/11/2019-GST) and provides much-needed clarity for manufacturers, distributors, dealers, and tax professionals.

In this Handout, we will cover:

- Meaning of secondary/post-sale discounts

- Treatment of Input Tax Credit (ITC)

- Whether such discounts are “consideration”

- Impact when linked to promotional services

- Practical examples, tabular comparison & flowcharts

- Key compliance takeaways

What are Secondary or Post-Sale Discounts?

- These are discounts given after the original supply is completed.

- Unlike trade discounts (shown on the invoice), these are usually issued through financial or commercial credit notes after the sale.

👉 Example: Manufacturer sells goods to a dealer at ₹10,00,000 + GST. Later, issues a ₹50,000 discount (without adjusting GST). This is a post-sale discount.

Issue 1: Availability of ITC to Recipient When Discounts Are Given

Clarification by CBIC:

- As per Section 16(1) of CGST Act, ITC can be availed on inputs used in business.

- When suppliers issue financial/commercial credit notes (not reducing tax liability), there is no reduction in transaction value.

Hence, recipient does not need to reverse ITC.

Example 1:

- Invoice: ₹1,00,000 + GST ₹18,000.

- Dealer avails ITC = ₹18,000.

- Supplier issues credit note ₹10,000 (without GST impact).

👉 Dealer continues to keep full ITC ₹18,000.

⚠️ Note: If the supplier issues a GST credit note under Section 34(1) with GST adjustment, then both supplier’s liability and recipient’s ITC reduce proportionately.

Issue 2: Post-Sale Discount as Consideration for Dealer’s Supply to End Customer

CBIC View:

- Section 2(31), CGST Act defines “consideration” to include any inducement for supply.

- But in normal trade practice, manufacturer → dealer → customer are two independent sales.

- Dealer sells on principal-to-principal basis; discounts are only to push sales, not for any independent service.

Example 2 (No GST Impact):

- Manufacturer sells to dealer @ ₹1,000/unit + GST.

- Dealer sells to customer @ ₹1,200/unit.

- Manufacturer issues discount of ₹100/unit later.

👉 This discount reduces dealer’s cost, not a consideration. No GST impact.

⚠️ Exception:

- If the manufacturer has an agreement with end customer to provide goods at a reduced price, and uses the dealer as a channel, then the discount becomes inducement and forms part of consideration.

Example 3 (GST Impact):

- End customer contract: Price = ₹900/unit.

- Dealer sells to customer @ ₹900/unit.

- Manufacturer reimburses dealer via discount ₹100/unit.

👉 This discount is inducement for dealer’s supply, hence part of consideration.

Issue 3: Discount vs Promotional Activities by Dealer

Clarification by CBIC:

- Normal discounts = Reduction in price = Not taxable.

- If dealer performs specific promotional services for manufacturer (ads, co-branding, exhibitions, customer campaigns, etc.), then it becomes supply of service, taxable under GST.

Example 4 (Not Taxable):

Manufacturer gives dealer a discount for achieving target sales volume.

👉 Just a price reduction. No GST.

Example 5 (Taxable):

Dealer runs a co-branded TV ad campaign for the manufacturer, cost reimbursed via discount.

👉 This is a service by dealer to manufacturer, GST is payable.

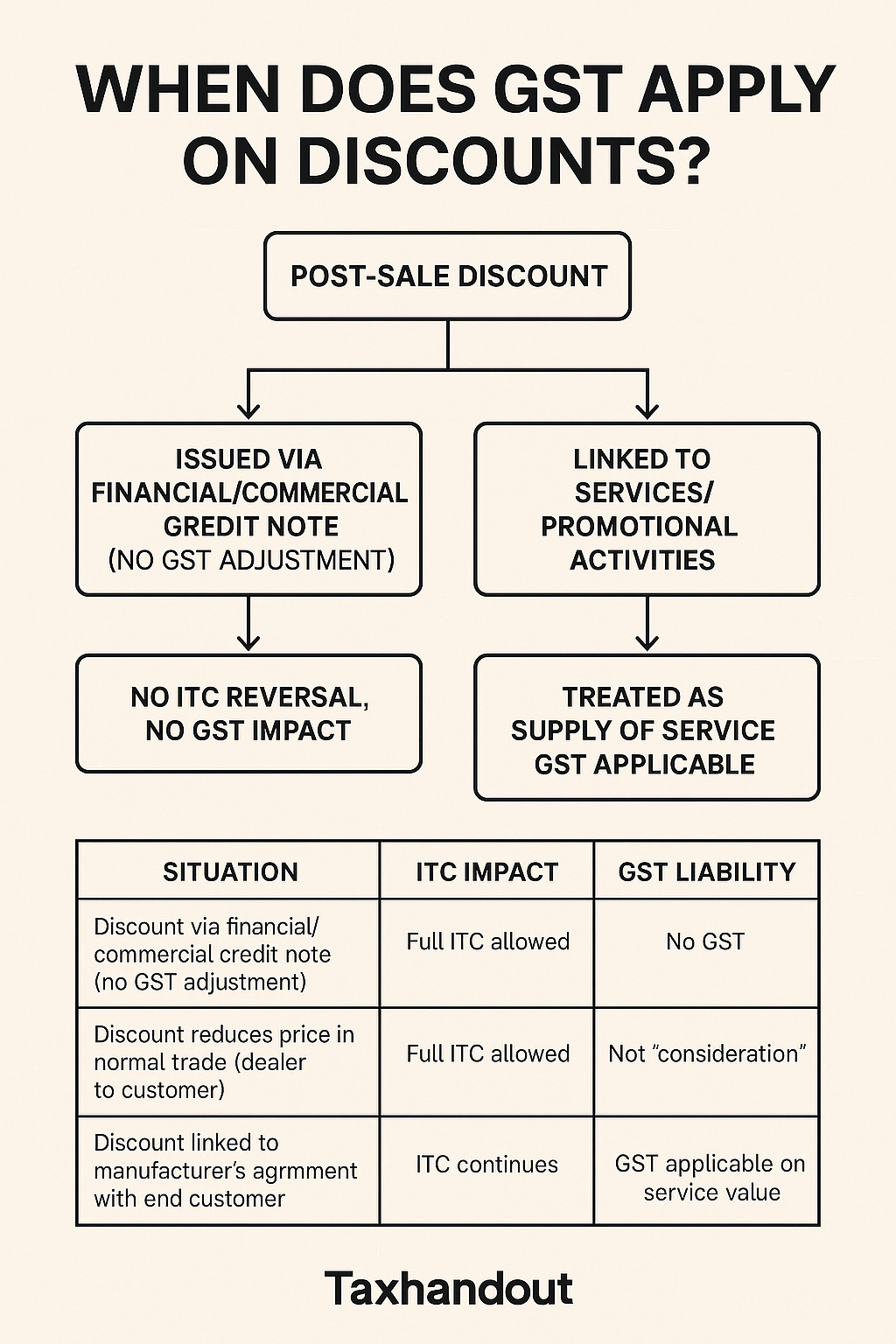

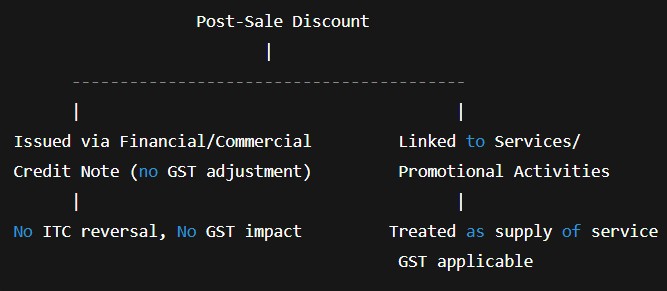

Flowchart: When Does GST Apply on Discounts?

| Situation | ITC Impact | GST Liability |

| Discount via financial/commercial credit note (no GST adjustment) | Full ITC allowed | No GST |

| Discount reduces price in normal trade (dealer to customer) | Full ITC allowed | Not “consideration” |

| Discount linked to manufacturer’s agreement with end customer | Full ITC allowed | May be treated as “consideration” |

| Dealer provides promotional activities (ads, branding, events) | ITC continues | GST applicable on service value |

Key Compliance Takeaways

- Dealers can keep full ITC when suppliers issue commercial/financial credit notes without GST adjustment.

- Normal trade discounts do not attract GST—they only reduce cost price.

- Manufacturer-end customer agreements may turn discounts into consideration.

- Promotional services by dealers are distinct supplies → GST applies.

- Businesses should differentiate clearly between:

- Trade discounts (not taxable), and

- Service reimbursements (taxable).

Conclusion

The CBIC Circular 251/08/2025 provides much-needed uniformity in handling post-sale discounts under GST.

- For dealers and distributors: No ITC reversal needed in most cases.

- For manufacturers: Ensure agreements are structured carefully to avoid unintended GST liability.

- For tax professionals: This circular helps in advising clients with legal clarity and avoiding disputes.

👉 Bottom Line:

Not all discounts are taxable. Only those linked to end-customer contracts or promotional services attract GST.