🔍 Introduction

Great news for small businesses and startups.

The Government of India has introduced Rule 14A and Rule 9A under the CGST Rules, 2017, to simplify GST registration.

With these rules, businesses can now get a GST number within few minutes of applying — thanks to an automated, Aadhaar-verified system that removes manual delays.

Let’s understand the new fast-track registration system in detail.

⚡ Auto-Approval of GST Registration (Rule 9A)

Under Rule 9A, GST registration can now be auto-approved within 3 working days, and in many cases, within just few minutes.

Key Highlights

- Approval based on data analytics and risk parameters.

- No officer intervention in most applications.

- Entirely system-driven process, ensuring transparency and speed.

Once you complete Aadhaar verification and upload all documents correctly, your GSTIN may be generated automatically on the same day.

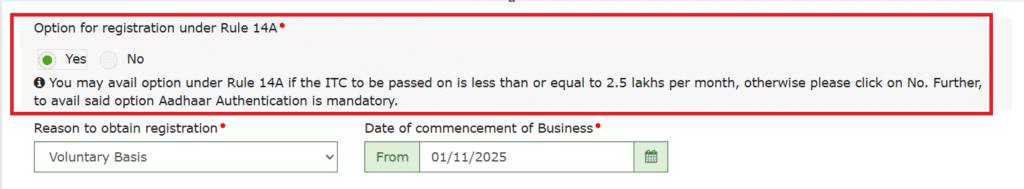

🟢 Simplified Registration Option (Rule 14A)

Rule 14A is designed especially for small taxpayers who voluntarily register under GST.

Eligibility

- Monthly B2B output GST liability ≤ ₹2.5 lakh.

- Suitable for freelancers, small service providers, and startups.

Benefits

✅ Faster GST registration approval.

✅ Lesser scrutiny and documentation.

✅ Simplified compliance for low-risk taxpayers.

If you meet this criterion, select “Yes” under Rule 14A while filling Form REG-01 on the GST portal.

🔐 Aadhaar Authentication is Mandatory

To use Rule 14A, Aadhaar authentication is compulsory.

Process

- OTP-based verification on Aadhaar-linked mobile number and email.

- Without Aadhaar verification, the fast-track option is not available.

This step ensures genuine identification of applicants and prevents misuse or fake registrations.

🚫 One Registration Per State

Under Rule 14A, taxpayers can obtain only one GST registration per PAN per State.

This restriction helps prevent creation of multiple dummy registrations and improves control over registration frauds.

⏱ Registration Approval Timeline

| Condition | Approval Timeline |

|---|---|

| Aadhaar Verified | Within 3 working days |

| Aadhaar Not Verified | Physical verification / Officer scrutiny required |

The entire process — from application to approval — happens online through the GST portal.

🔄 How to Exit from Rule 14A

If you later want to opt out of Rule 14A registration, file FORM GST REG-32 (Application for Withdrawal).

Conditions to Withdraw

- All GST returns must be filed.

- Minimum filing conditions must be satisfied:

- Before 1 April 2026 → 3 months’ returns filed.

- On/after 1 April 2026 → At least 1 tax period return filed.

After verification, the officer will issue:

- REG-33 → Withdrawal Approved.

- REG-05 → Withdrawal Rejected.

📄 Updated Forms Under Rule 14A

The GST registration forms have been updated for this simplified process.

Revised Forms

- REG-01 – Application for registration

- REG-02 – Acknowledgement

- REG-03 – Notice for clarification

- REG-04 – Reply to clarification

- REG-05 – Order of rejection

New Forms Introduced

- REG-32 – Application for Withdrawal under Rule 14A

- REG-33 – Order for Withdrawal Approval

🎯 Key Takeaways

- ✅ Get GST number within 1 hour of application.

- ✅ Aadhaar-based authentication is compulsory.

- ✅ Simplified process for small businesses.

- ✅ System-driven approval ensures faster processing.

- ✅ Helps eliminate fake or dummy registrations.

💡 Conclusion

The introduction of Rule 14A and Rule 9A marks a major step in making GST registration faster and more transparent.

Small taxpayers can now obtain GST registration quickly, securely, and without manual delays, ensuring smooth business commencement and compliance.

If your monthly B2B output GST liability is within ₹2.5 lakh and Aadhaar verification is done — you can now get your GST number in just one hour.

Very interesting, I like the content

Thank You.