If you’re a QRMP taxpayer who was recently blocked from filing a GST refund, you’re not alone. A new system validation on the GST Portal was incorrectly flagging compliant businesses, preventing them from making claims.

We have good news: The GST Network (GSTN) has officially announced that this technical issue is now resolved.

The Backstory: The Refund Filing Rule

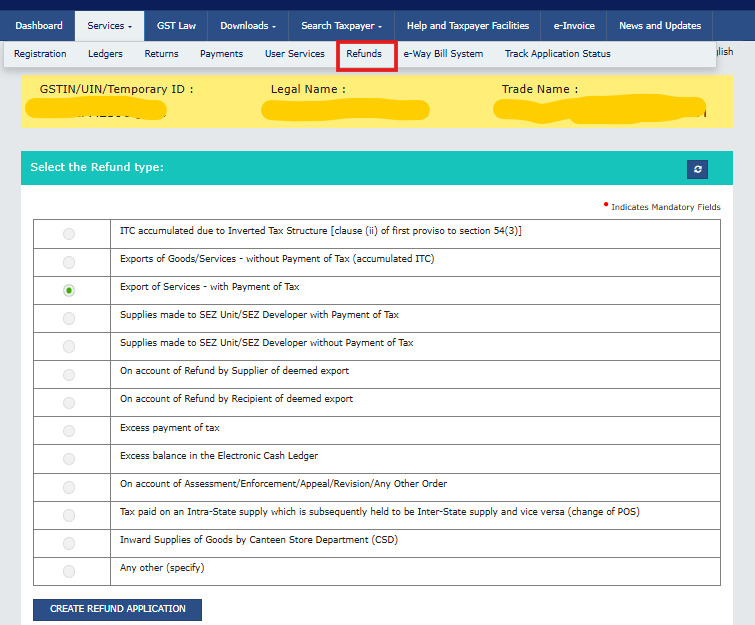

First, a quick refresher on the fundamental rule for claiming any GST refund. As per GST law (Circular No. 125/44/2019-GST), you can only file a refund application if you have submitted all your required returns (like GSTR-1 and GSTR-3B) that were due up to that date.

To enforce this, a new validation was recently added to the GST Portal to automatically check your filing history before allowing a refund claim.

The Problem: Why QRMP Taxpayers Got Stuck

This new system check, while well-intentioned, created a major headache for QRMP taxpayers. Here’s why:

- Quarterly Filing: Under the QRMP scheme, you file your main returns (GSTR-1 and GSTR-3B) once every quarter.

- Monthly Reporting: However, for the first two months of the quarter (let’s call them M1 and M2), you report your B2B invoices using the Invoice Furnishing Facility (IFF).

The new system validation failed to recognize the invoices you uploaded via the IFF. It mistakenly flagged your returns for months M1 and M2 as “not filed,” even though they weren’t due yet. This error effectively blocked legitimate refund applications, causing significant delays and frustration for businesses.

The Golden Rule for QRMP Refund Claims

While the glitch is gone, there is a very important rule you must follow to ensure your refund application is successful.

You can only claim a refund for invoices that are part of a GSTR-3B return that has already been filed.

Let’s make this crystal clear:

- DO include invoices from a previous quarter for which you have already submitted your quarterly GSTR-3B.

- DO NOT include invoices you have reported via IFF for the current quarter if the final GSTR-3B for that quarter hasn’t been filed yet.

Example: It’s May 2025. You have filed your GSTR-3B for the Jan-Mar 2025 quarter. You can now apply for a refund related to transactions from the Jan-Mar quarter. However, you cannot include invoices from April 2025 (which you reported via IFF) in this refund claim, because the GSTR-3B for the April-June quarter is not yet due or filed.

Conclusion

The system error that blocked QRMP refund applications is fixed. To file successfully, ensure your claim is based only on returns (GSTR-3B) that have already been filed. This simple check will help you get your refund processed without any issues.