What is GSTR-4?

GSTR-4 is an annual return to be filed by composition taxpayers under the GST regime. It is filed once a year, unlike regular taxpayers who file monthly or quarterly returns.

📌 Applicability: Only for taxpayers who have opted for the Composition Scheme under Section 10 of the CGST Act.

If a taxpayer has opted out of the composition scheme during the year, they must file GSTR-4 only for the period they were under the scheme.

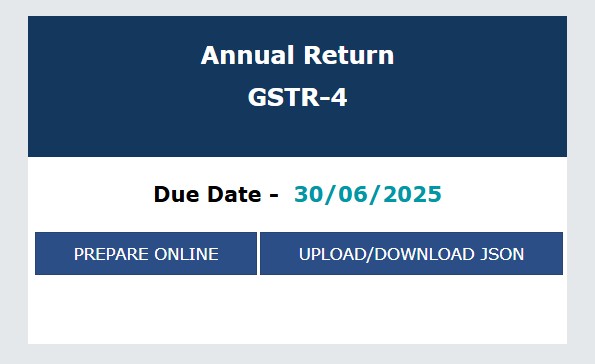

📅 Due Date of GSTR-4

| Financial Year | GSTR-4 Due Date |

| 2024–25 | 30th June 2025 (Extended Due Date) |

Usually, it must be filed on or before 30th April of the succeeding financial year.

What Does GSTR-4 Contain?

GSTR-4 includes:

- Summary of Outward Supplies (Taxable & Exempt)

- Inward Supplies attracting Reverse Charge

- Tax liability and tax paid

- Details of advances paid

- Amendments of previous returns

- HSN Summary (Optional)

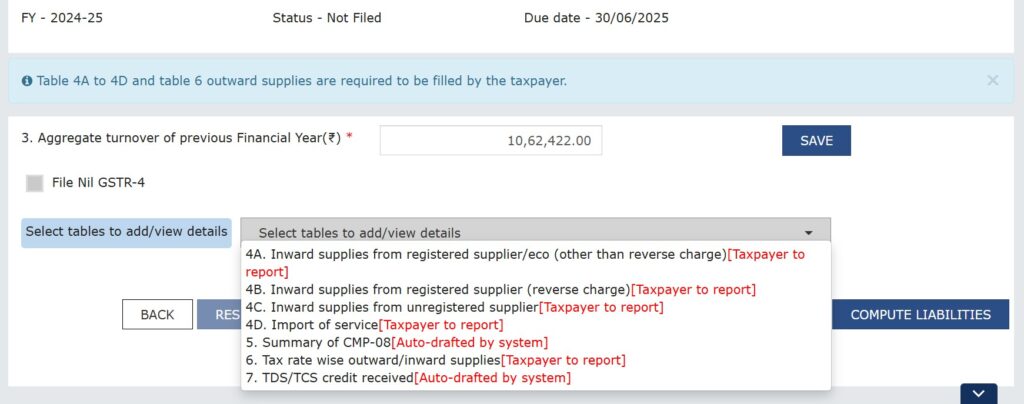

How to File GSTR-4? (Step-by-Step on GST Portal)

- Login to www.gst.gov.in

- Navigate to Returns → Annual Return → GSTR-4

- Enter details in each table:

- 4A: Inward supplies attracting RCM (Match it with auto populated details available in quarterly returns)

- 4B: B2B purchases (non-RCM)

- 6: Outward supplies summary

- Click on ‘Compute Liability’

- Pay tax dues if any using Form GST PMT-06

- File with DSC/EVC

Comparison: GSTR-4 vs CMP-08

| Particulars | GSTR-4 (Annual) | CMP-08 (Quarterly) |

| Filing Frequency | Once a year | Every quarter |

| Return Type | Detailed summary | Tax payment form only |

| Period Covered | Full financial year | Quarterly |

| Due Date | 30th April (following FY) | 18th of the month after quarter ends |

Late Fees & Penalty for GSTR-4

| Condition | Late Fee (CGST + SGST) |

| NIL Return | ₹25 + ₹25 per day = ₹50/day |

| Tax Liability | ₹100 + ₹100 per day = ₹200/day |

| Maximum Late Fee | ₹500 for NIL return₹2,000 for others |

Non-filing of GSTR-4 may lead to blocking of e-way bill generation and cancellation of registration.

FAQs on GSTR-4

Q1. Do I need to file GSTR-4 if no transaction in the year?

✅ Yes, a NIL GSTR-4 must be filed if no outward or inward supplies occurred.

Q2. Can I revise GSTR-4 after filing?

❌ No. GSTR-4 cannot be revised once filed.

Q3. Is there ITC allowed for composition taxpayers ?

❌ No ITC is allowed under composition scheme. GSTR-4 only reports liability.

Conclusion

Filing GSTR-4 annual return is a vital compliance for composition taxpayers, even if there are no transactions during the year. Ensuring timely and accurate filing helps avoid penalties and ensures smooth functioning of the GST registration.

Stay compliant, stay updated – and if you’re unsure, consult a GST practitioner for assistance.