The CBIC, through Notification No. 13/2025 – Central Tax dated 17th September 2025, has made significant amendments to the Annual Return Form GSTR-9 & 9C. These changes, applicable from FY 2024-25 onwards, aim to improve accuracy in ITC reporting, reconciliation with GSTR-3B & 2B, and prior-period adjustments.

In this Handout, we explain the major changes in GSTR-9 & 9C for FY 2024-25 in a simple and practical way.

A. GSTR-9

1. New Sub-Tables for ITC Reporting (6A1 & 6A2)

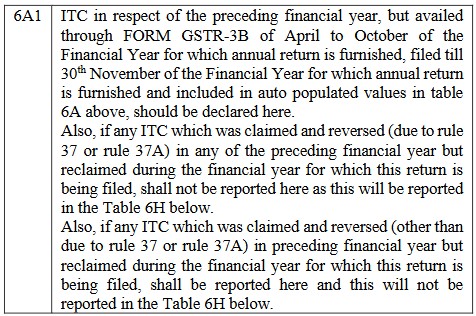

- 6A1 – ITC of the preceding financial year availed in the current financial year (through GSTR-3B of April to October, filed till 30th November).

- 6A2 – Net ITC of the current financial year (after excluding 6A1).

2. Expansion of Table 6M

- Table 6M will now capture ITC availed through:

- ITC-01 (credit on new registration/ voluntary registration),

- ITC-02 / ITC-02A (credit transfer on merger/demerger, business transfer).

3. Linkage of ITC Reversal & Reclaim (Tables 6H & 7)

- ITC availed, reversed, and later reclaimed will now be disclosed in a linked manner:

- ITC availed first time → Table 6B.

- ITC reversed → Table 7.

- ITC reclaimed → Table 6H.

- Special provisions:

- If reversal was due to Rule 37 / 37A (non-payment to supplier) and reclaimed later → Report in 6H.

- If reversal was due to other reasons and reclaimed → Report in 6A1.

3(a).Rule-Wise Reporting of ITC Reversals

Earlier, GSTR-9 only had a consolidated reporting of ITC reversals.

Now, from FY 2024-25, taxpayers must separately report reversals as per specific CGST Rules:

- Rule 37 – Non-payment to supplier within 180 days.

- Rule 37A – ITC reversal for supplier not paying tax (linked with GSTR-3B mismatch).

- Rule 38 – Reversal for banking companies (50% ITC option).

- Rule 39 – ISD distribution of credit.

- Rule 42 – Common ITC apportionment for exempt & taxable supplies (inputs/input services).

- Rule 43 – Capital goods ITC reversal.

- Section 17(5) – Blocked credits (e.g., motor vehicles, personal consumption).

- Transition Credit reversals – Claimed through TRAN-1/2 but later reversed.

4. New Disclosures for Import ITC

- Table No 8H1: IGST credit availed on imports in next financial year.

- 8H1: Out of 8G, the portion of ITC on imports availed in the next year must be disclosed separately.

5. Revised Tables 10–13 for Prior Period Adjustments

From FY 2024-25 onwards:

- Table 10: Upward amendments (invoices, debit notes) relating to current FY but reported up to October of next FY.

- Table 11: Downward amendments (credit notes, amendments) reported up to October of next FY.

- Table 12: Reversal of ITC relating to current FY but reported in next FY.

- Table 13: ITC relating to current FY availed in next FY (up to October).

6. Auto-Population of ITC in Table 8

For FY 2024-25 onwards, ITC declared in Table 6B will be auto-populated in Table 8B.

7. Instruction Updates

- Cut-off date: Transactions of a financial year can be corrected/adjusted only up to 30th November of next FY (aligned with Sec. 16(4) ITC rule).

- Language in instructions updated for FY 2024-25.

B. GSTR-9C

1. New Disclosure for E-Commerce Transactions (Section 9(5))

- A new row 7D1 has been added in Part II – Reconciliation of Turnover.

- Supplies on which tax is to be paid by e-commerce operators u/s 9(5) must now be reported by the supplier.

- In Part III – Reconciliation of Tax Paid, a new row K-2 has been inserted.

- E-commerce operators themselves must disclose such supplies on which they are liable to pay tax.

2. Reconciliation of Turnover – Revised Formula

- Earlier formula was E = (A-B-C-D).

- Now it is E = (A-B-C-D-D1) to account for new disclosure of e-commerce operator supplies.

3. Additional Liability Reporting Updated

- In Table 11 (Additional amount payable but not paid):

- Earlier only “cash” was considered.

- Now it covers cash or ITC as mode of settlement.

- Separate line item introduced for:

- “Supplies on which e-commerce operator is required to pay tax u/s 9(5).”

4. Part V – Additional Liability on Non-Reconciliation

- Earlier: “Cash”

- Now: “Cash or ITC”

- Ensures all unsettled liabilities are captured whether payable through cash ledger or electronic credit ledger.

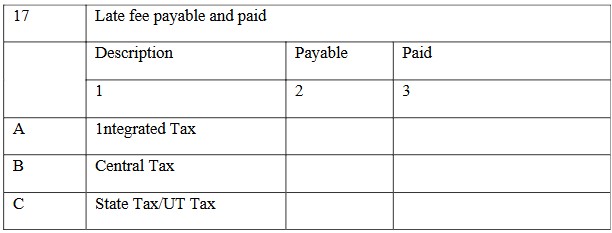

5. Late Fee Disclosure Added

- A new row added in Part V – Table 17 for Late Fee payable & paid under Section 47(2).

- Must be shown separately for IGST, CGST, SGST/UTGST.

6. Instruction Updates

- Year references updated to cover FY 2024-25.

- Specific instructions for e-commerce supplies:

- Supplier must declare such supplies in 7D1.

- Operator must declare in K-2.

Key Takeaways

- Taxpayers must maintain rule-wise ITC registers (especially for Rule 37/37A reversals).

- ERP/accounting systems should be updated to separately track:

- ITC of current year,

- ITC of previous year claimed this year,

- ITC reversed & reclaimed.

- Import-related ITC disclosures will require ICEGATE data reconciliation.

- Prior-period amendments must be closely tracked and reported in the right table.

- E-commerce operators now have direct liability reporting in GSTR-9C.

- Suppliers selling via e-commerce platforms must also report such supplies distinctly.

- Businesses must ensure dual reporting matches between supplier & operator.

- Additional liabilities can now be tracked as cash or ITC, not just cash.

- Late fee reporting made mandatory for FY 2024-25.