Mutual fund investments are popular among Indian taxpayers due to their potential for wealth creation and tax efficiency. However, capital gains from mutual funds—whether short-term (STCG) or long-term (LTCG)—must be reported accurately in your Income Tax Return (ITR) to avoid penalties and notices.

This handout will explain:

- Which ITR form to use

- How to report STCG & LTCG in the correct table

- Tax rates applicable

- Filing deadlines for AY 2025–26

- Practical tips to ensure correct reporting

1. Which ITR Form is Applicable?

| ITR Form | When to Use |

| ITR-2 | For individuals with capital gains from mutual funds and no business/professional income |

| ITR-3 | For individuals having business/professional income along with mutual fund gains |

Salaried individuals with mutual fund investments usually need ITR-2.

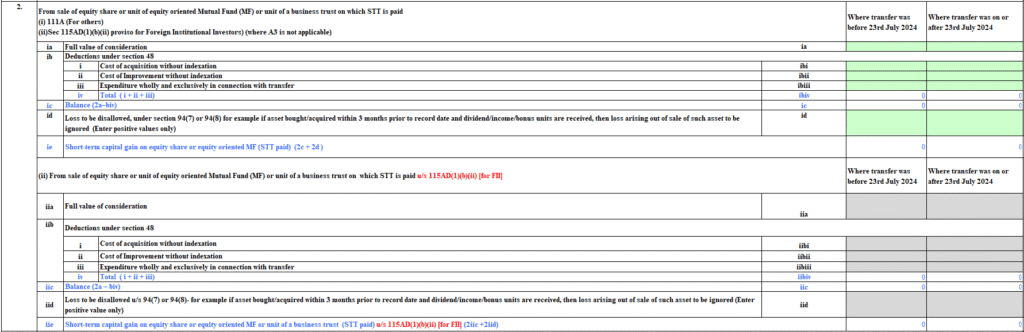

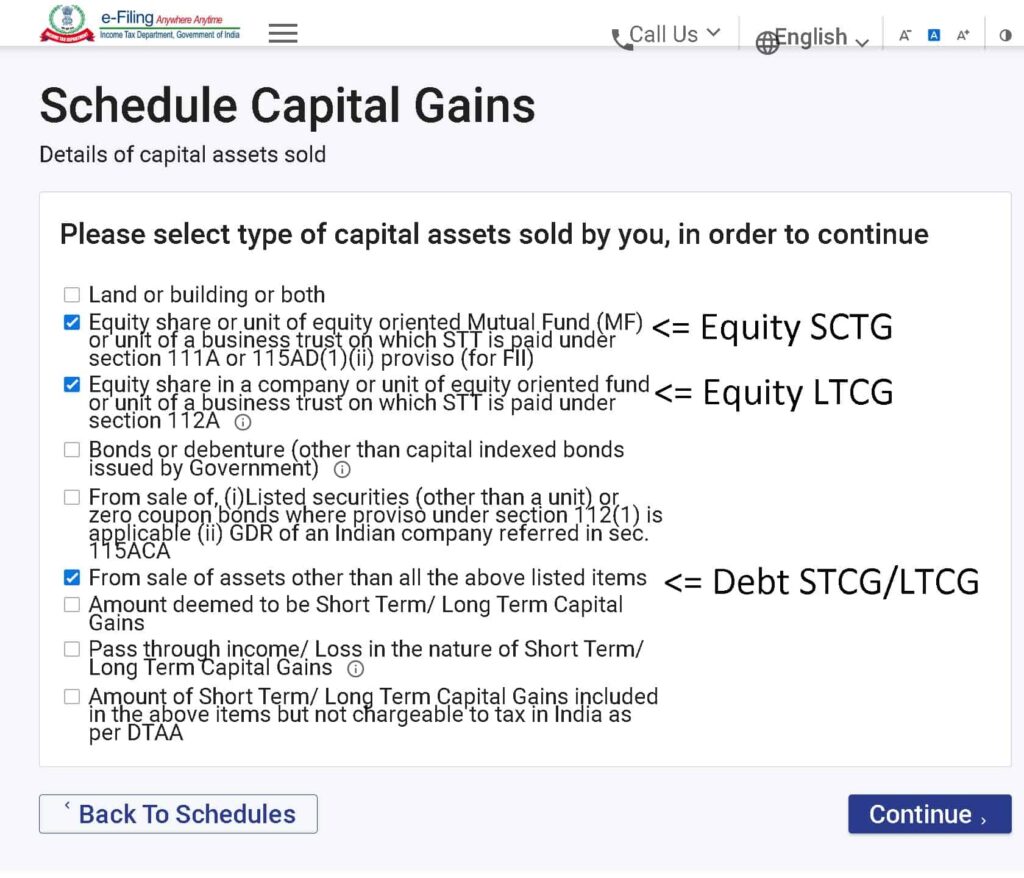

2. Where to Report Mutual Fund Capital Gains in ITR

Mutual fund gains are declared in Schedule CG (Capital Gains). You must report equity-oriented and debt-oriented mutual funds separately.

Screenshot: ITR-2/ITR-3 : Schedule Capital Gains (Mutual Fund Reporting)

In this section, you choose the relevant asset type and enter purchase/sale details, cost, consideration, and exemptions.

3. Table for Reporting LTCG & STCG

A. Long-Term Capital Gains (LTCG)

- Equity Mutual Funds: Holding > 12 months

- Debt Mutual Funds: Holding > 36 months

| Field | Details to Fill |

| ISIN / Fund Name | Enter ISIN or mutual fund name |

| Date of Acquisition | Purchase date |

| Date of Sale | Redemption date |

| Sale Consideration | Amount received |

| Purchase Price | Buy price |

| Exemptions (if any) | e.g., u/s 54F |

| LTCG Amount | Auto-calculated |

| Tax Rate | 10% (Equity) / 20% with indexation (Debt) |

B. Short-Term Capital Gains (STCG)

- Equity Mutual Funds: Holding ≤ 12 months

- Debt Mutual Funds: Holding ≤ 36 months

| Field | Details to Fill |

| ISIN / Fund Name | Enter ISIN or mutual fund name |

| Date of Acquisition | Purchase date |

| Date of Sale | Redemption date |

| Sale Consideration | Amount received |

| Purchase Price | Buy price |

| STCG Amount | Auto-calculated |

| Tax Rate | 15% (Equity) / Slab rate (Debt) |

4. Tax Rates on Mutual Fund Income

| Fund Type | LTCG Tax Rate | STCG Tax Rate |

| Equity-oriented | 10% above ₹1 lakh/year (no indexation) | 15% flat |

| Debt-oriented | 20% with indexation | Slab rate |

| Hybrid | Based on equity % | Same as above |

5. Dividend Income from Mutual Funds

- Taxable at your slab rate under “Income from Other Sources”

- TDS @10% if dividend > ₹5,000/year per AMC

6. ITR Filing Deadline for AY 2025–26

- 31 July 2025 – Individuals not requiring audit. (Extended to 15 Sept 2025)

- 31 October 2025 – Audit cases (business/profession)

7. Filing Tips

- Download Consolidated Capital Gains Statement from CAMS/KFintech

- Match with AIS/TIS on the Income Tax portal

- Use correct ISIN codes & dates to avoid mismatches

- Keep equity & debt fund entries separate

8. Example

Investment: ₹2,00,000 in Equity MF on 01-Apr-2023

Redeemed: ₹2,50,000 on 15-May-2024 (holding > 12 months)

LTCG = ₹50,000 → Below ₹1 lakh → No tax payable

Conclusion

Reporting mutual fund capital gains correctly in ITR ensures compliance and prevents future tax disputes. Always use the correct ITR form, fill Schedule CG carefully, and file before the deadline.