The GST regime in India relies on a globally accepted coding system for classifying goods — the HSN Code. With the GSTN portal rolling out a critical update from May 2025, businesses must now adapt to new rules around how HSN data is entered and validated.

Let’s understand the basics first and then delve into what’s new on the portal.

What is HSN Code ?

HSN stands for Harmonized System of Nomenclature, developed by the World Customs Organization. It standardizes the classification of goods across the globe. Under GST, HSN codes help in:

- Identifying the correct GST rate (5%, 12%, 18%, 28%)

- Ensuring uniform classification across India and internationally

- Facilitating import/export compliance

Each HSN code can be up to 8 digits:

- First 2 digits: Broad category

- 3rd & 4th digits: Sub-category

- 5th & 6th digits: Detailed product level

- 7th & 8th digits: Customs use (export/import)

HSN Code Applicability Based on Turnover

| Annual Turnover | HSN Digits Required | Invoice Type |

| Up to ₹5 crore | 4 digits | Mandatory for B2B only |

| Above ₹5 crore | 6 digits | Mandatory for all invoices |

| Above ₹25 crore or Exports/Imports | 8 digits | Mandatory |

This structure ensures that businesses apply accurate GST rates and maintain transparency in tax compliance.

New GSTN Portal Requirements from May 2025

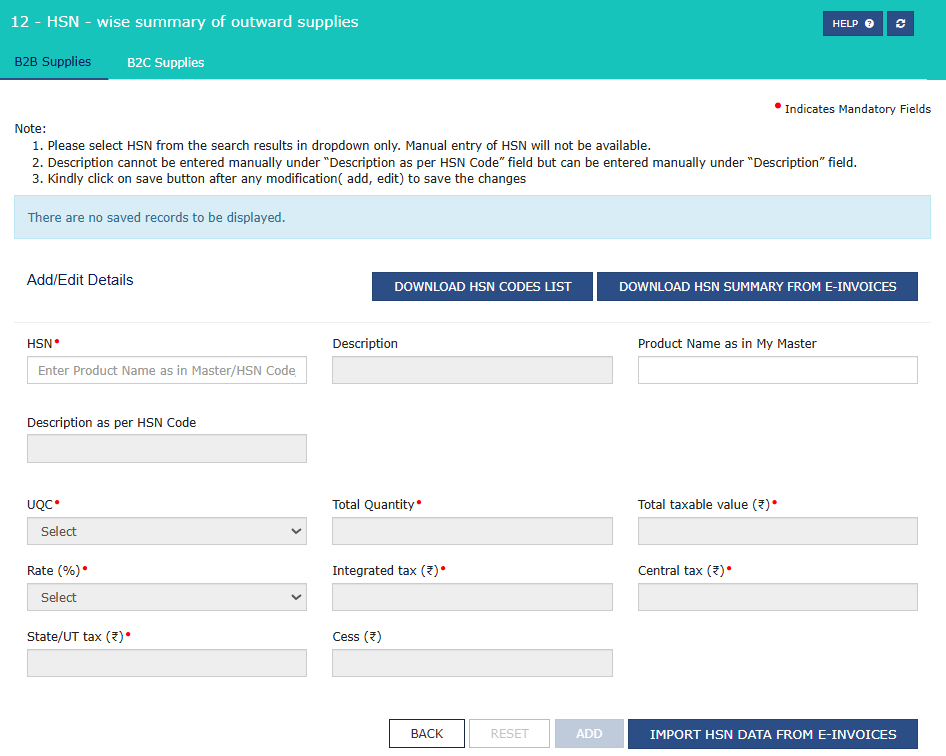

With the rollout of Phase 3 HSN Validations, several critical changes have been made in Table 12 of GSTR-1/GSTR-1A:

- Split Tabs: HSN data must now be reported separately under:

- B2B Supplies

- B2C Supplies

- No Manual Entry: You must now select HSN from a dropdown list. Manual input is disabled to avoid incorrect codes.

- Auto-Populated Descriptions:

- The official HSN description now appears in a new field called “Description as per HSN Code”.

- Cross-Table Validations:

- Values declared in Table 12 must match those reported in other supply tables (like 4A, 5A, 6A etc.).

- Initially, mismatches will only trigger warnings — but this may become stricter over time.

- New Functional Tools:

- “Download HSN Codes List”: Helps download the latest official HSN/SAC list.

- Searchable HSN Master: Simplifies selecting the right HSN linked to your products.

Table-12 HSN Validation: B2B vs B2C Bifurcation

GSTN now validates HSN data based on the nature of the recipient:

B2B HSN includes:

- Tables: 4A, 4B, 6B, 6C, 8 (Registered)

- 9A, 9B (Registered)

- 9C (Registered)

- 15, 15A (Recipient Registered)

B2C HSN includes:

- Tables: 5A, 6A (Export)

- 7A, 7B, 8 (Unregistered)

- 9A (Export), 9A (B2CL)

- 9B, 9C (Unregistered)

- 10, 15, 15A (Unregistered)

Ensure that HSN data in each tab matches the value breakdown across these related tables.

Common Issues Taxpayers are Facing

- Leaving B2B/B2C tabs blank even after reporting supplies elsewhere in GSTR-1.

- Using outdated or invalid HSN codes that are no longer in the dropdown list.

- Attempting to manually input HSN codes (which the portal now disallows).

- Mismatch in values between Table 12 and other parts of GSTR-1.

These errors are resulting in warning messages and in some cases, inability to proceed with filing.

Many users are getting the error: “HSN wise B2B supplies are not reported in Table 12.” This happens even though there is no values in GSTR-1 related to B2B. Portal mandates at least one HSN entry in B2B tab of Table 12. We hope this will fix soon.

Best Practices and Solutions

Update your invoicing systems to capture and report HSN-wise summaries for both B2B and B2C.

Download the latest HSN list from the portal to avoid using invalid codes.

Cross-verify values before submission to avoid mismatch warnings.

Don’t skip Table 13 (Documents Issued) – it’s now mandatory.

Final Words

HSN codes may look like just numbers, but they are the backbone of correct GST filing. With GSTN tightening data validation, businesses need to step up their compliance practices to avoid errors and potential notices. Embrace the updates and stay compliant.