In the last few days, many taxpayers have received a system-generated email from the Income Tax Department asking them to revise their ITR for AY 2025–26 to report foreign assets or foreign income.

If you think “I already paid tax” or “My foreign balance is small”—stop right there. That thinking is exactly what leads to penalties.

This Handout explains why this alert email is issued, what mistakes taxpayers commonly make, and how to fix it correctly.

Why Are These Emails Being Sent?

The Income Tax Department has received information from foreign jurisdictions (like the USA) under international information-sharing agreements.

If their data shows that you:

- Held a foreign bank or brokerage account

- Earned foreign dividend or interest

- Held foreign shares, ESOPs, RSUs, ETFs

- Owned any foreign asset

…and Schedule FA is blank or incomplete in your ITR, the system flags your return.

This is not a manual scrutiny. It is data-driven and automated.

What Is Schedule FA and Why Is It Critical?

Schedule FA (Foreign Assets) is a disclosure schedule.

Tax payment is secondary. Disclosure is mandatory.

Key points taxpayers miss:

- Schedule FA must be filled even if income is exempt or already taxed

- Even zero income foreign assets must be disclosed

- Dormant or low-balance accounts still count

- Holding an asset for one day during the year triggers reporting

Failure to disclose can invite penalties under Black Money Act, even if tax evasion is not involved.

Common Situations That Trigger This Notice

Let me be blunt. These are the most frequent mistakes:

1. Foreign Shares / RSUs / ESOPs

- Vested RSUs not disclosed in Schedule FA

- Shares sold reported in capital gains, but holding not disclosed

- Employer sold shares to recover perquisite tax → still report

2. Foreign Brokerage Account

- Dividend reinvested abroad → still foreign income

- Balance not repatriated → Schedule FA required every year

3. Foreign Bank Account

- Old student or salary account left open

- Low or zero balance → still report

4. Foreign Insurance / Investment Policies

- Surrender value exists → disclosure mandatory

5. “Dividend Already Taxed Abroad”

- Tax paid abroad does NOT remove Schedule FA obligation

What Exactly Does the Email Ask You to Do?

The email clearly states:

- Data shows you held or earned foreign assets/income in Calendar Year 2024

- Schedule FA was not included in AY 2025–26 ITR

- You must revise your ITR by 31st December

- Applicable ITR Form must be other than ITR-1 or ITR-4

Ignoring this is not an option.

Step-by-Step: What You Should Do Now

Step 1: Identify All Foreign Assets

Prepare a list of:

- Foreign bank accounts

- Brokerage accounts

- Shares, RSUs, ESOPs

- Foreign dividends or interest

- Foreign insurance or property (if any)

Step 2: Check Original ITR

Verify:

- Was Schedule FA filled?

- Was it partially filled or completely blank?

- Was the correct ITR form used?

Step 3: File Revised Return

- Login to income tax portal

- Choose Revised Return

- Fill Schedule FA carefully

- Cross-verify dates, peak values, country codes

- Ensure Schedule OS / FSI / TR / Form 67 are consistent (if applicable)

Step 4: Do Not Change Figures Blindly

Incorrect disclosure is worse than late disclosure.

If values are wrong, you are creating a bigger compliance issue.

How to Fill Schedule FA in ITR – Step-by-Step Practical Guide

First, Understand One Non-Negotiable Rule

Schedule FA is always filled on:

- Calendar Year basis (1 Jan to 31 Dec)

- NOT Financial Year

For AY 2025–26 → Report foreign assets held at any time during 01-01-2024 to 31-12-2024.

If you mix FY with CY, your disclosure becomes technically incorrect.

Where Will You Find Schedule FA?

After selecting the correct ITR (ITR-2 or ITR-3):

👉 Go to

Schedule FA – Details of Foreign Assets & Income

You will see multiple sub-sections. You only fill what is applicable. No need to fill all.

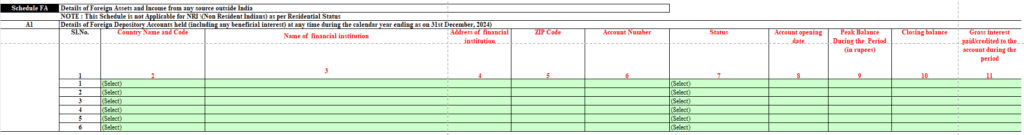

Section A1 – Foreign Bank Accounts

Who should fill this?

If you held any foreign bank account, even:

- Dormant

- Zero balance

- Old salary / student account

What details are required?

- Country name

- Bank name & address

- Account number

- Account opening date

- Peak balance during calendar year

- Closing balance on 31-12-2024

Important reality check:

If you closed the account during the year, it is still reportable.

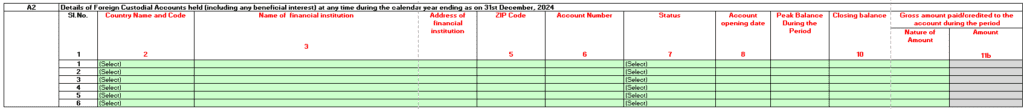

Section A2 – Foreign Custodial / Brokerage Accounts

If you have:

- US brokerage (Robinhood, E*Trade, Schwab, etc.)

- Any foreign investment account holding assets

You must disclose:

- Name of institution

- Country

- Account number

- Peak balance

- Closing balance

Do not confuse this with shares reporting.

Shares go in A3, brokerage account goes in A2.

Both can exist together.

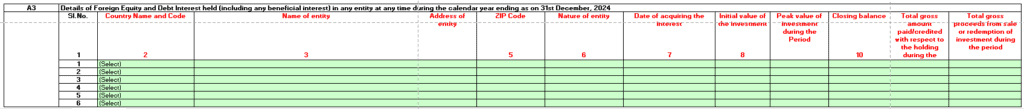

Section A3 – Financial Interest in Foreign Entity (Shares / RSUs / ESOPs)

This is where most mistakes happen.

This section covers:

- Foreign listed shares

- RSUs vested

- ESOPs exercised

- Holdings through foreign brokerage

How to report correctly:

- Report number of shares held

- Cost of acquisition (as per vesting / purchase)

- Country of entity

- Whether income is derived (Yes/No)

Even if:

- Shares were sold later

- Employer sold shares to recover tax

- No dividend received

👉 Holding = disclosure mandatory

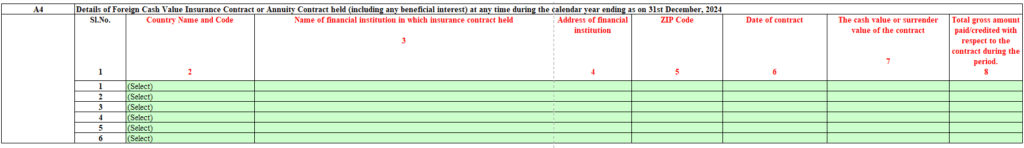

Section A4 – Foreign Insurance Policies

If the policy has:

- Surrender value

- Investment component

Then report:

- Country

- Policy number

- Name of insurer

- Surrender value

Pure term insurance → not required

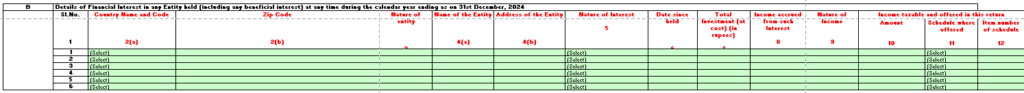

Section B – Details of Financial Interest In any Entity

You must disclose:

- Country & address

- Date of Contract

- Surrender Value of the contract

- Total Gross amount paid.

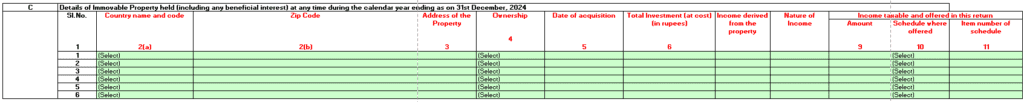

Section C – Immovable Property Outside India

If you owned:

- Foreign house

- Land

- Apartment

You must disclose:

- Country & address

- Date of acquisition

- Total investment

- Ownership percentage

Even if:

- Property is vacant

- No rent earned

Section D – Other Capital Assets

Used rarely, but covers:

- Foreign bonds

- Foreign mutual funds

- ETFs not falling elsewhere

Section E – Details of accounts in which you have signing authority

Used rarely, but covers:

- Name & Address of the Institution

- Country Name & Address

- Account Number & Name of Holder

- Peak Balance

- Income Accrued

Section F – Details of Trust, created outside India.

Used rarely, but covers:

- Name & Address of the Institution

- Country Name & Address

- Account Number & Name of Holder

- Peak Balance

- Income Accrued

Section G – Details of any other Income.

Used rarely, but covers:

- Name & Address of the Institution

- Country Name & Address

- Account Number & Name of Holder

- Peak Balance

- Income Accrued

Important Deadlines and Consequences

| Particulars | Impact |

| Last date to revise ITR | 31 December |

| Non-disclosure of foreign assets | Penalty up to ₹10 lakh |

| Wrong disclosure | Risk of scrutiny |

| Ignoring system email | High risk case selection |