The Income Tax Department has introduced some updates to the ITR forms for the Assessment Year 2025-26 (covering income from April 1, 2024, to March 31, 2025). If you’re planning to file ITR 2 for AY 2025-26, here’s a simple breakdown of the key changes—so you can stay compliant

Who Should File ITR 2?

ITR 2 is for individuals and Hindu Undivided Families (HUFs) who do not earn income from business or profession.

You should file ITR 2 if you have:

- Salary or pension income

- Income from more than one house property (rented or self-occupied)

- Capital gains from sale of stocks, mutual funds, or property

- Other income like bank interest, dividends, lottery winnings, etc.

- Are a director in a company or hold unlisted shares

- Foreign income or foreign assets

- Agricultural income above ₹5,000

- Total income above ₹50 lakh

Don’t use ITR 2 if:

You have income from business, profession, or are a partner in a firm—use ITR 3 instead.

What’s New in ITR 2 for AY 2025–26?

Let’s unpack the major changes:

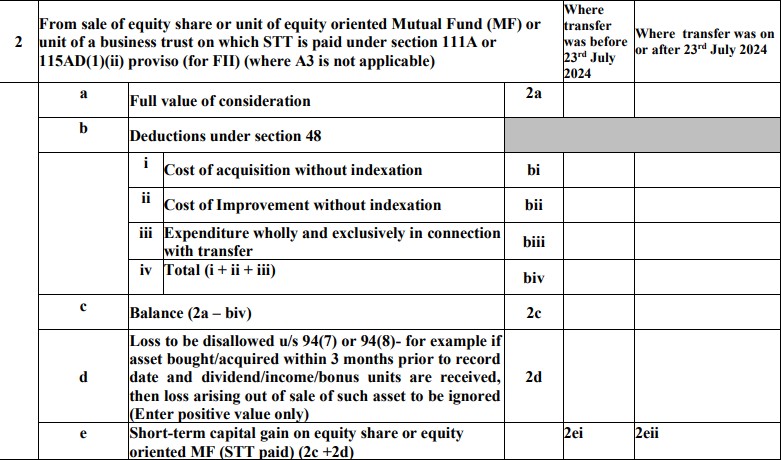

1. Capital Gains – Track the Sale Date

What’s new?

You’ll now have to specify whether the sale date of your assets (shares, mutual funds, property, etc.) was before or after July 23, 2024.

Why?

New tax rules may apply to gains from sales on or after this date.

What to do?

Keep a record of exact sale dates to report them correctly—ITR 2 will likely have separate columns for each period.

2. Share Buy-Back = Dividend Income (from Oct 1, 2024)

What’s new?

If a listed Indian company buys back its shares from you on or after October 1, 2024, it will be treated as dividend income, not capital gains.

What it means:

This income will be shown under “Income from Other Sources”, and you might report a capital loss on the shares—useful for adjusting future gains.

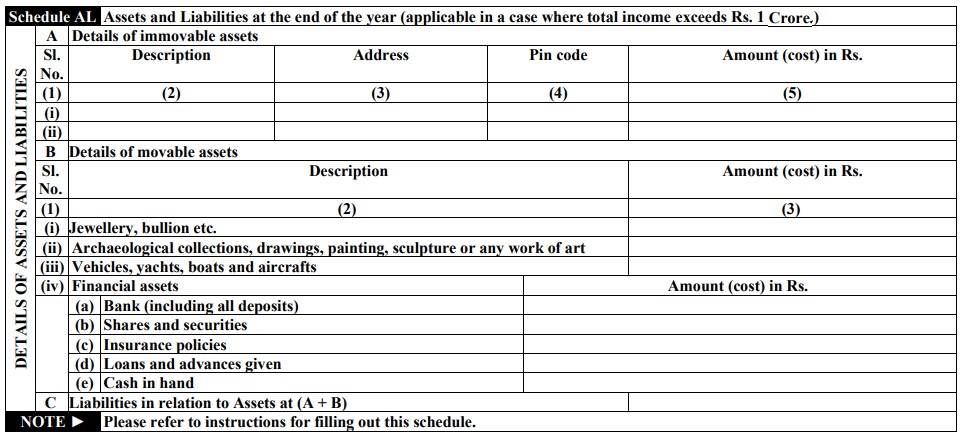

3. Relaxed Asset Reporting – Only Above ₹1 Crore

What’s new?

You now have to fill Schedule AL (Assets & Liabilities) only if your total income exceeds ₹1 crore.

Earlier the limit was ₹50 lakh.

Good news?

Yes! If your income is below ₹1 crore, you save time and skip this detailed section.

4. More Disclosure for Common Deductions

What’s new?

Claiming deductions under HRA, home loan interest, or education loan? You’ll need to give more info, like:

- For HRA: Rent paid, city of work, HRA received, basic salary

- For Home/Education Loans: Lender’s name, loan A/C number, sanction date, total loan amount, outstanding balance

Why?

It helps the department verify your claims faster. Keep documents ready—like rent receipts, loan statements, and interest certificates.

5. Aadhaar is Mandatory – Enrollment ID Not Accepted

What’s new?

You can no longer file your return using just the Aadhaar Enrollment ID.

What to do?

Ensure you have your actual Aadhaar number before filing.

6. TDS Section Must Be Mentioned

What’s new?

If TDS (Tax Deducted at Source) was applied by someone other than your employer (like a tenant or client), you now need to mention the TDS section number (e.g., 194I for rent).

Why?

This makes TDS claims easier to verify and avoids mismatches. You’ll find the section code in your Form 26AS or TDS certificates.

7. Disability Deductions Need Certificate Acknowledgment

What’s new?

To claim deductions under Section 80DD or 80U, you must provide the acknowledgment number of the disability certificate, and Form 10-IA (if required).

Pro tip:

Get your certificate updated if it’s expired and retain acknowledgment details for smooth processing.

Difference between ITR-1 and ITR-2 (AY 2025-26)

| Particulars | ITR-1 (Sahaj) | ITR-2 |

|---|

| Who Can File | Resident Individuals (Ordinary Residents) | Individuals and Hindu Undivided Families (HUFs) |

| Business/Profession Income | Not Allowed | Not Allowed (If you have business income, file ITR-3) |

| Income from Salary | ✅ Allowed | ✅ Allowed |

| Income from House Property | ✅ Allowed (only for 1 house property) | ✅ Allowed (for multiple house properties) |

| Income from Capital Gains | ❌ Not Allowed | ✅ Allowed (Short-term & Long-term Capital Gains) |

| Other Sources (Interest, etc.) | ✅ Allowed (excluding Lottery, Race Horses, etc.) | ✅ Allowed (including all types of other income) |

| Agricultural Income | Allowed only if up to ₹5,000 | ✅ Allowed (Even if above ₹5,000) |

| Foreign Income / Assets | ❌ Not Allowed | ✅ Mandatory to disclose |

| Clubbing of Income | ❌ Not allowed | ✅ Allowed (Minor/Spouse income clubbing cases) |

| Residential Status Eligibility | Only for Resident and Ordinarily Resident (ROR) | Both Residents & Non-Residents (NR/ RNOR) allowed |

| Capital Gains Carry Forward/Set Off | ❌ Not Allowed | ✅ Allowed |

| Applicable For | Simple taxpayers with income up to ₹50 lakh, with only one house property, no capital gains, no foreign income/assets | People with more than one house property, capital gains, foreign income, agricultural income > ₹5,000, or clubbing of minor/spouse income |

In a Nutshell

These ITR 2 AY 2025-26 updates are focused on:

- More transparency

- Better data matching

- Smoother return processing

📌 Your Checklist:

- Keep sale/purchase dates, rent slips, loan info, and certificates ready

- Ensure your Aadhaar number is updated

- Check your Form 26AS and AIS

File before September 15, 2025 to avoid last-minute rush.

❓ FAQ on ITR-2 for AY 2025-26

Q1: Can I file ITR-2 if I have income from a partnership firm?

A: No. If you have income from a partnership firm, you should file ITR-3.

Q2: What if I have both salary and capital gains income?

A: If you have salary income along with capital gains, especially if the LTCG exceeds ₹1.25 lakh or involves carry-forward losses, you should file ITR-2.

Q3: Is it mandatory to report all bank accounts?

A: Yes, you must report all active bank accounts held in India during the financial year. Dormant accounts (inactive for over two years) are exempt.

Q4: What happens if I miss the filing deadline?

A: Missing the deadline can result in penalties and loss of certain benefits like carrying forward losses. However, you can file a belated return by December 31, 2025.

Useful information

Thank you

Pingback: ITR-1 Explained: Eligibility, Recent Changes & Common Mistakes

NON RESIDENT KA TOUR AND TRAVEL KA COMMISSION INCOME KE LIYE KAUN SA ITR FILING KARNA HAI

For an NRI earning commission from a tour and travel business in India, ITR-3 is almost always the correct form to use.

Your Income is “Business Income”: Even though it’s commission, it comes from a business activity (tour and travel).

The Indian tax rules have a simpler form ITR-4, (also called “Sugam”) for small businesses that lets you declare a fixed percentage of your income as profit. However, this is only for residents of India. Since you’re a Non-Resident Indian (NRI), you can’t use ITR-4.

The official instructions from the Income Tax Department clearly state that ITR-4 cannot be used by a Non-Resident.

The simplified tax schemes that ITR-4 supports (like Sections 44AD and 44ADA) are exclusively for residents.

So, even if your commission income is small, your status as an NRI means ITR-4 is out.

In a Nutshell

If you’re an NRI earning tour and travel commission in India, just remember: ITR-3 is your form. It’s built for your kind of income and your residential status.