Confused between the Old and New Tax Regime in India? Don’t worry — you’re not alone. With two different tax systems available, choosing the right one can feel overwhelming. But in this blog, we’ll simplify everything for you — so you can make a smart choice and save on taxes. Let’s break it down like a friendly guide.

Option 1: Old Tax Regime – The Traditional Road

The Old Regime is what most people in India have been using for years.

✅ Why choose the Old Regime?

Because it’s full of tax-saving options!

💰 Tax-Saving Deductions Allowed:

- Section 80C (₹1.5 lakh limit): Investments in PPF, ELSS, LIC, Home Loan Principal, etc.

- Health Insurance Premium (Section 80D)

- Home Loan Interest (Section 24b) – up to ₹2 lakh

- House Rent Allowance (HRA)

- Education Loan Interest (Section 80E)

- Donations (Section 80G)

- Standard Deduction of ₹50,000 for salaried

Basically, the more you save and invest smartly, the lower your taxable income becomes.

🧾 Old Regime Tax Slabs (AY 2025-26)

| Income Slab | Tax Rate |

|---|

| Up to ₹2.5 lakh | Nil |

| ₹2.5 lakh – ₹5 lakh | 5% |

| ₹5 lakh – ₹10 lakh | 20% |

| Above ₹10 lakh | 30% |

Great for: Investors, salaried people with HRA/home loans, and taxpayers with high deductions.

Option 2: New Tax Regime – The Simpler Highway

The New Regime was launched to simplify tax filing — fewer exemptions, but lower rates.

🔍 Key Highlights:

- Lower tax rates

- No deductions allowed (except a few)

- No paperwork needed

- Default regime from FY 2023-24 onwards

✅ Deductions Still Allowed:

- Standard Deduction of ₹75,000 (from AY 2025-26 for salaried)

- Employer’s NPS Contribution

- Family Pension Deduction

New Regime Tax Slabs (AY 2025-26):

| Income Slab | Tax Rate |

| 0 – ₹3 lakh | Nil |

| ₹3 – ₹6 lakh | 5% |

| ₹6 – ₹9 lakh | 10% |

| ₹9 – ₹12 lakh | 15% |

| ₹12 – ₹15 lakh | 20% |

| Above ₹15 lakh | 30% |

Special Rebate:

- No tax up to ₹7 lakh (AY 2025-26)

- No tax up to ₹12 lakh (AY 2026-27) with rebate

Great for: Those with low deductions, simple income structure, or income below ₹12 lakh.

Old vs New Regime: How to Decide?

Here’s a quick decision chart for you:

| Situation | Best Regime |

| Have home loan + rent + 80C + health insurance | Old Regime |

| Salary below ₹7 lakh and few deductions | New Regime |

| Hate paperwork and prefer simple filing | New Regime |

| Maximize savings with ELSS, PPF, insurance | Old Regime |

If your total deductions are more than ₹3.75 to ₹4.5 lakh, Old Regime is likely better.

Can You Switch Between Regimes?

Yes, But there’s a catch depending on your income type.

For Salaried Individuals:

- Switch every year as per your choice

- Declare your choice to employer (for TDS)

- Even if you told your employer one regime, you can switch while filing ITR

For Business or Professional Income (Doctors, Shop Owners, Freelancers):

- Form 10-IEA is mandatory to opt Old Regime

- You can switch back to New Regime only ONCE in lifetime

- Be extra cautious before switching

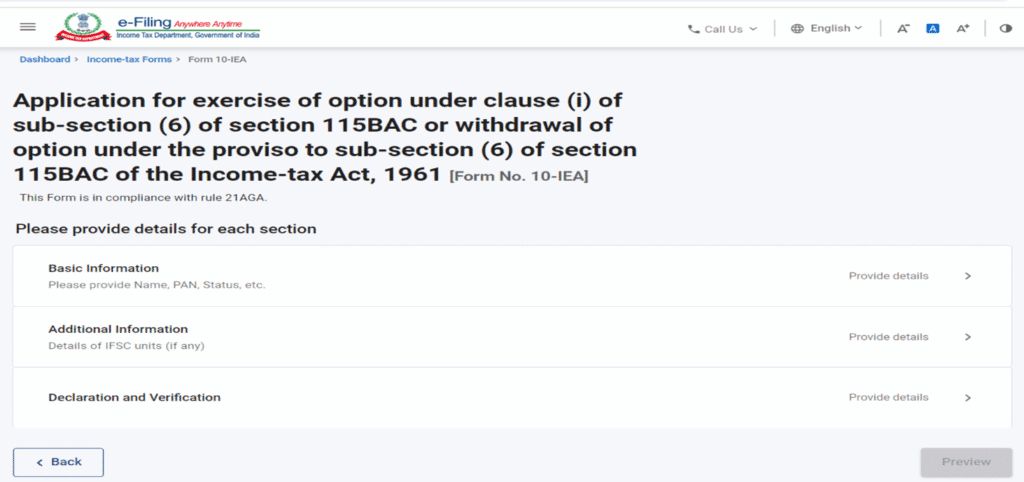

How to File Form 10-IEA?

- File it before due date of original ITR (usually 31st July or later for audit cases)

- Submit it on Income Tax portal → e-File → Income Tax Forms → File Income Tax Forms → Form 10-IEA

Can You Change Regime After Filing ITR?

If you are Salaried:

- Yes, by filing a revised return (if original was on time)

- Deadline: 31st December of the assessment year

If you have Business Income:

- Only possible if Form 10-IEA was already filed

- You can revise return and switch to New Regime only once in lifetime

Final Thoughts: Old or New?

Choose New Regime if:

- You don’t invest/save much

- You prefer simple filing

- Your income is below ₹7 lakh (rebate benefit)

✅ Stick with Old Regime if:

- You claim big deductions (home loan, insurance, rent)

- You actively invest under 80C, 80D, etc.

- You want to reduce taxable income through planning

Key Takeaways:

The New Tax Regime is all about simplicity and potentially lower rates, but it means letting go of most tax deductions. The Old Tax Regime lets you save a lot by investing and spending in specific ways, even if the rates look higher initially.

Always compare both options for your specific income and deductions each year. And if you have a business, make your decision carefully, as it has long-term effects.