Under the Goods and Services Tax (GST) regime, tax is usually payable by the supplier of goods or services. However, in certain cases, the law shifts the responsibility to the recipient — this is called the Reverse Charge Mechanism (RCM).

RCM was introduced to ensure tax compliance in specific situations, especially where the supplier is unregistered or belongs to a category notified by the Government.

In this handout, we will cover:

- Relevant sections and rules

- Cases where RCM applies

- Time of supply & payment rules

- ITC eligibility on RCM

- Self-Invoicing under Reverse Charge

- Compliance tips and common mistakes

1. Relevant sections and rules

- Section 9(3) of CGST Act, 2017 – Government notifies certain goods and services where the tax is payable by the recipient.

- Section 9(4) of CGST Act, 2017 – Tax on supplies from unregistered persons to registered persons (currently applicable only in notified cases).

- Section 5(3) & 5(4) of IGST Act, 2017 – Similar provisions for inter-State supplies.

- Relevant Rules – Rule 46 (Tax invoice), Rule 47 (Time limit for issuing invoice), Rule 47A (Special provision for self-invoice in certain services under RCM), Rule 36 (ITC).

2. Cases where RCM applies

A. Services Notified under Section 9(3)

| Entry | Description | SAC Code | GST Rate | Notification No. | Applicability |

| 1 | GTA – Transport of goods by road | 9965 | 5% (No ITC) / 12% (With ITC) | 13/2017-CT (Rate) | 01.07.2017 |

| 2 | Legal Services | 9982 | 18% | 13/2017-CT (Rate) | 01.07.2017 |

| 3 | Arbitral Tribunal | 9982 | 18% | 13/2017-CT (Rate) | 01.07.2017 |

| 4 | Sponsorship | 9983 | 18% | 13/2017-CT (Rate) | 01.07.2017 |

| 5 | Govt. services to business entities (exclusions apply) | Various | 18% | 13/2017-CT (Rate) | 01.07.2017 |

| 5A | Govt. rent of immovable property | 9972 | 18% | 13/2017-CT (Rate) | 01.07.2017 |

| 5AA | Rent of residential dwelling to registered person | 9972 | 18% | 05/2022-CT (Rate) | 18.07.2022 |

| 5AB | Rent of immovable property (non-residential) | 9972 | 18% | 09/2024-CT | 10.10.2024 |

| 5B | Transfer of development rights / FSI to promoter | 9972 | As applicable | 05/2019-CT (Rate) | 01.04.2019 |

| 5C | Long-term lease of land to promoter | 9972 | As applicable | 05/2019-CT (Rate) | 01.04.2019 |

| 6 | Director’s services | 9991 | 18% | 13/2017-CT (Rate) | 01.07.2017 |

| 7 | Insurance agent services | 9971 | 18% | 13/2017-CT (Rate) | 01.07.2017 |

| 8 | Recovery agent services | 9985 | 18% | 13/2017-CT (Rate) | 01.07.2017 |

| 9 | Music composer, photographer, artist – copyright | 9983 | 12% / 18% | 13/2017-CT (Rate) | 01.07.2017 |

| 9A | Author – copyright to publisher | 9983 | 12% / 18% | 22/2019-CT (Rate) | 01.10.2019 |

| 10 | Overseeing Committee to RBI | 9991 | 18% | 13/2017-CT (Rate) | 01.07.2017 |

| 11 | Vessel transport from outside India to customs | 9965 | 5% | 10/2017-IGST (Rate) | 01.07.2017 |

| 12 | Direct Selling Agents (DSAs) | 9971 | 18% | 13/2017-CT (Rate) | 01.07.2017 |

| 13 | Business Facilitator to bank | 9971 | 18% | 29/2018-CT (Rate) | 01.01.2019 |

| 14 | Agent of business correspondent to BC | 9971 | 18% | 29/2018-CT (Rate) | 01.01.2019 |

| 15 | Security services | 9985 | 18% | 29/2018-CT (Rate) | 01.01.2019 |

| 16 | Renting of motor vehicle to body corporate (fuel incl.) | 9966 | 5% | 29/2019-CT (Rate) | 31.12.2019 |

| 17 | Lending of securities under SEBI Scheme | 9991 | Exempt / As applicable | 22/2019-CT (Rate) | 01.10.2019 |

| 18 | Import of Services | Various | As applicable | 10/2017-IGST (Rate) | 01.07.2017 |

B. Goods Notified under Section 9(3)

| Goods | Supplier | Recipient | GST Rate |

| Cashew nuts, not shelled or peeled | Agriculturist | Registered person | 5% |

| Bidi wrapper leaves (tendu) | Agriculturist | Registered person | 18% |

| Raw cotton | Agriculturist | Registered person | 5% |

| Supply of lottery | State Govt./Local authority | Lottery distributor | As applicable |

C. Section 9(4) – Supplies from Unregistered Persons

Section 9(4) originally mandated that a registered person receiving goods or services from an unregistered supplier must pay GST under RCM. However, due to compliance burden, the provision was later restricted to specified notified categories.

Current Applicability:

- Applicable only for supplies of specified goods/services notified by the Government.

- Major example: Promoters in the real estate sector must pay GST under RCM on procurement of goods/services from unregistered suppliers exceeding 20% of total purchases (calculated project-wise).

- If such procurement exceeds the 20% limit, GST is payable on the excess.

- Certain supplies like cement from unregistered suppliers are taxable under RCM irrespective of the 20% threshold.

3. Time of Supply under RCM

For Goods (Section 12(3)):

Earlier of:

- Date of receipt of goods, or

- Date of payment, or

- 30 days from the date of supplier’s invoice

For Services (Section 13(3)):

Earlier of:

- Date of payment, or

- 60 days from the date of supplier’s invoice

4. ITC eligibility on RCM

- Payment must be made in cash through the Electronic Cash Ledger.

- ITC can be claimed in the same month when tax is paid, subject to Section 16 conditions.

- Self-invoicing is required under Rule 46 if supplier is unregistered.

5. Self-Invoicing under Reverse Charge

When you buy goods or services from an unregistered supplier and GST is payable under the Reverse Charge Mechanism (RCM), you must issue a self-invoice (Section 31(3)(f) CGST Act).

When Required:

- Purchase from unregistered suppliers covered under RCM.

- Import of services for business.

- Notified goods/services (e.g., tendu leaves, silk yarn, GTA services).

Contents:

- Your own name, address, GSTIN.

- Invoice number & date.

- Description, value, GST rate & amount.

- Place of supply / delivery.

Time Limit:

- Goods → On receipt.

- Services → On payment date.

Also issue a Payment Voucher (Section 31(3)(g)) at payment time.

Failure to self-invoice can attract penalties under Section 122.

6. Compliance tips and common mistakes

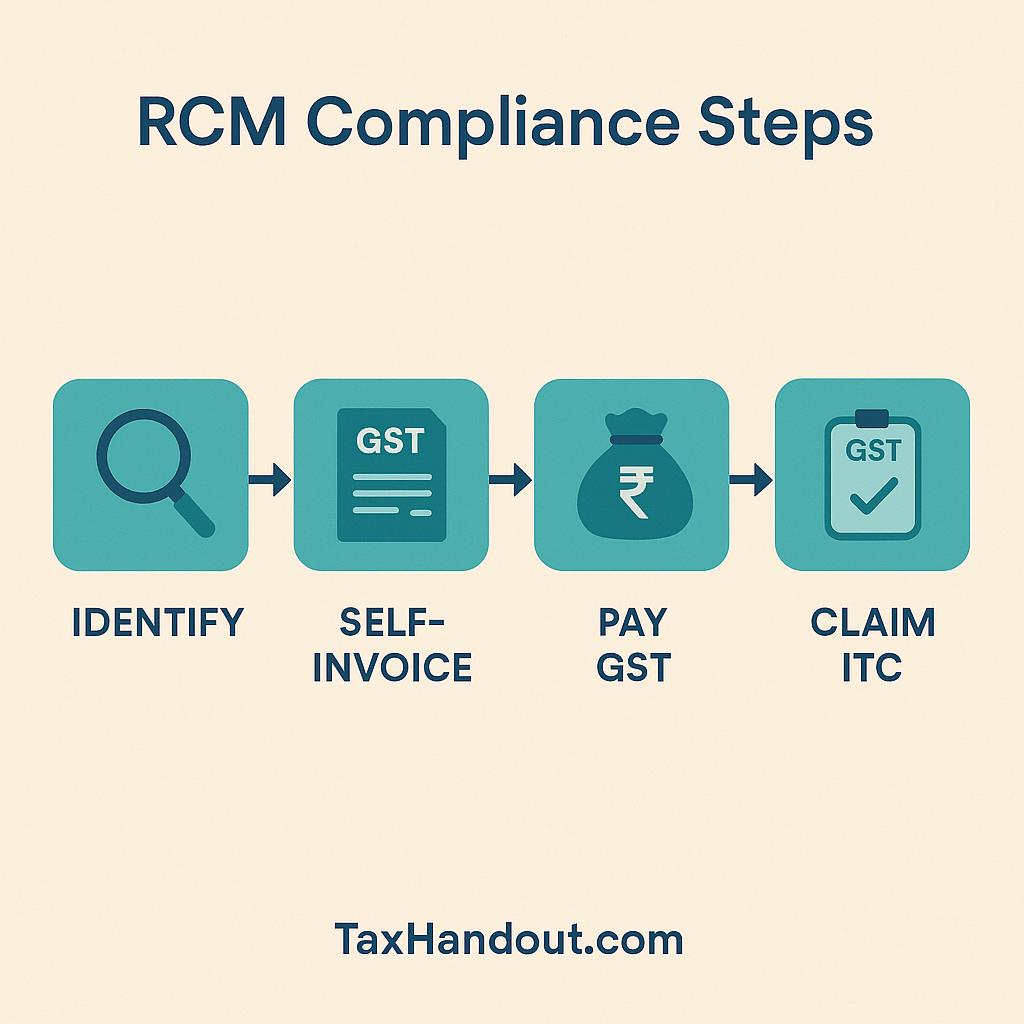

RCM Compliance Steps:

- Identify if transaction falls under RCM.

- Issue self-invoice (if supplier is unregistered).

- Pay GST through cash ledger.

- Report in GSTR-3B (Table 3.1(d)) and GSTR-1 (if applicable).

- Claim ITC in GSTR-3B (Table 4(A)(3)).

Common Mistakes to Avoid

- Treating all purchases from unregistered suppliers as RCM – only notified cases apply now.

- Missing time of supply deadlines.

- Forgetting self-invoice in unregistered cases.

- Claiming ITC without making actual cash payment.

Reverse Charge Mechanism ensures tax is collected in high-risk or unorganized sectors. While it increases compliance responsibility for recipients, proper record-keeping and timely payment help avoid penalties and interest.