The Central Board of Indirect Taxes and Customs (CBIC) has notified Rule 47A via Notification No. 20/2024 – Central Tax, which came into force on 1st November 2024. This rule provides a specific time limit for generating self invoicing where the tax liability is on the recipient under the Reverse Charge Mechanism (RCM).

Let’s understand the rule, its legal background, affected services, and how to comply with it.

Key Highlights of Rule 47A Self Invoicing

📅 Effective Date: 1st November 2024

📜 Notification: No. 20/2024 – Central Tax

🧾 Applicability: Where tax is payable under RCM, and the supplier is unregistered

📌 Timeline for Self-Invoice: 30 days from the receipt of goods or services

Legal Background – Relevant Sections of CGST Act, 2017

| Section | Explanation |

| Section 31(3)(f) | Mandates self-invoicing by the recipient when tax is payable under RCM. |

| Section 9(3) | RCM on notified goods/services like advocate services, GTA, etc. |

| Section 9(4) | RCM on supply from unregistered persons (limited to notified cases like promoters). |

| Section 13(3) | Time of supply for services under RCM: earlier of payment date, invoice date + 60 days, or self-invoice date. |

Rule 47A complements these sections by enforcing a clear 30-day deadline for generating self-invoices under RCM.

⚠️ Consequences of Non-Compliance

If the 30-day period is not adhered to, the recipient may face:

- Interest liability on delayed payment of GST under RCM

- Penalty for non-compliance under Section 122 of CGST Act

List of Services Covered Under RCM

Below is a compiled list of services on which Reverse Charge Mechanism is applicable under Section 9(3) & 9(4):

| Sl. No. | Service Category | RCM Applicability |

| 1 | Goods Transport Agency (GTA) | To specified recipients (e.g., factories, companies) |

| 2 | Legal Services | Individual advocates to business entities |

| 3 | Arbitral Tribunal Services | Tribunals to businesses |

| 4 | Sponsorship Services | To corporate bodies or partnership firms |

| 5 | Director’s Services (Non-Remunerative) | Directors to companies or body corporates |

| 6 | Insurance/Recovery Agent Services | Agents to banks/NBFCs |

| 7 | Govt. Services (excluding postal) | To registered business entities |

| 8 | TDR/FSI/Long-term lease (30+ years) | To promoters |

| 9 | Copyright by authors/artists | To publishers, producers |

| 10 | Direct Selling Agents (DSA) | Individual DSAs to banks/NBFCs |

| 11 | Business Correspondents/Facilitators | To banks |

| 12 | Security Services | To registered persons |

| 13 | Motor Vehicle Rental (with fuel) | By non-corporates to body corporates |

| 14 | Securities Lending (SEBI Scheme) | To borrowers through intermediaries |

| 15 | Rental of Immovable Property | By unregistered persons to registered recipients (from 10-Oct-2024) |

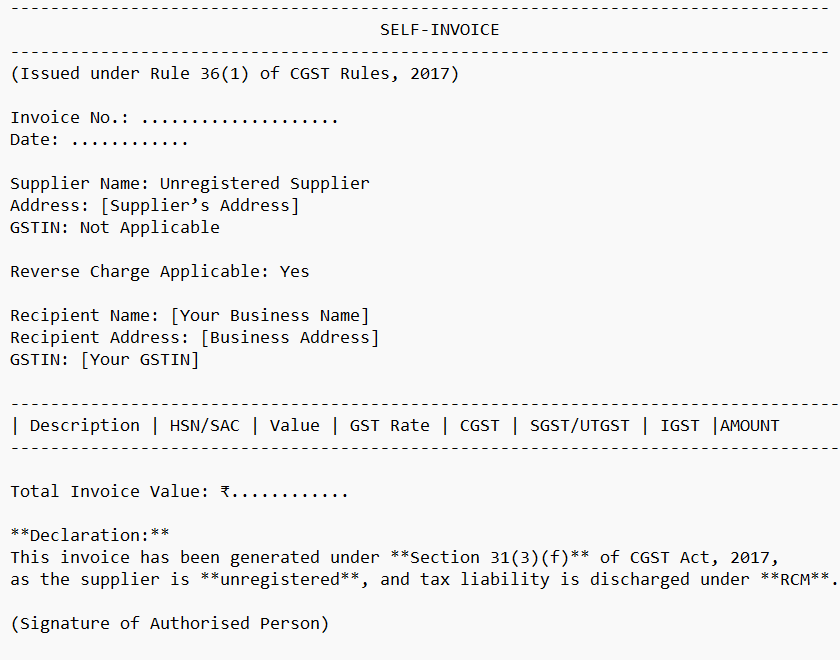

Refer to images below for complete visual list and official formatting:

Conclusion

Rule 47A Self Invoicing is a significant step toward strengthening RCM compliance. It closes a long-standing gap in the GST framework regarding time limits for self-invoicing and brings clarity for businesses dealing with unregistered suppliers.

To avoid interest or penalties, businesses must update their processes to issue self-invoices within 30 days of receiving such supplies.